What is a Traditional 401(k)?

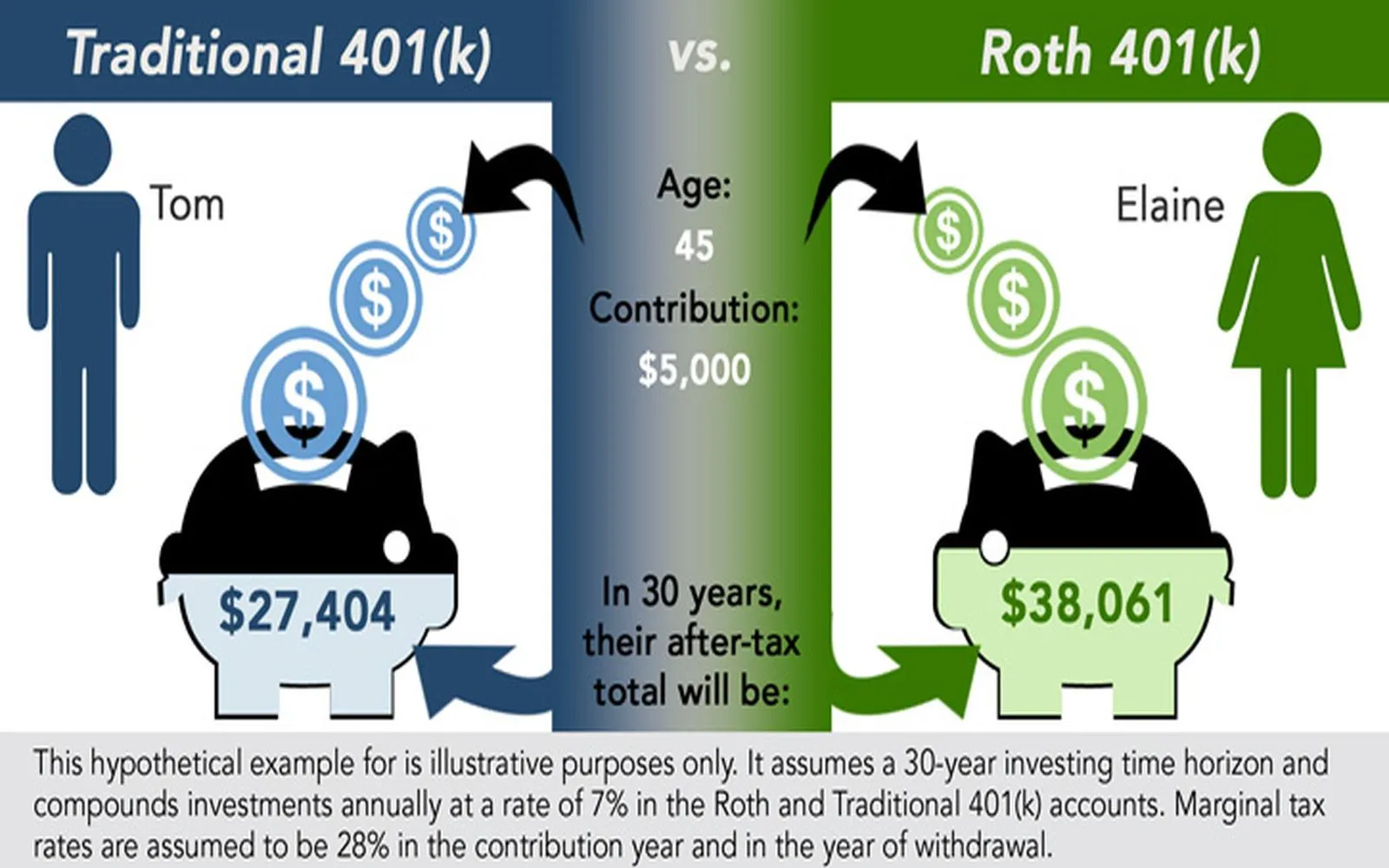

A Traditional 401(k) is a tax-deferred retirement account offered by many employers. Contributions to a Traditional 401(k) are made with pre-tax dollars, which means they lower your taxable income for the year you make the contribution. The money grows tax-deferred, meaning you don’t pay taxes on it until you withdraw it during retirement.

Key Features of Traditional 401(k):

- Contributions: Made with pre-tax dollars, reducing your current taxable income.

- Tax Benefit: You get a tax break in the year you contribute, which can lower your overall tax liability.

- Withdrawals: When you retire and start withdrawing funds, you will pay income taxes on those withdrawals at your ordinary tax rate.

- Required Minimum Distributions (RMDs): You must begin taking RMDs at age 73, regardless of whether you need the money.

What is a Roth 401(k)?

A Roth 401(k) is similar to a Traditional 401(k) in that it is offered through your employer, and both accounts allow you to contribute through payroll deductions. However, the major difference is that Roth 401(k) contributions are made with after-tax dollars. This means you don’t get a tax break when you contribute, but the growth in the account is tax-free, and qualified withdrawals in retirement are also tax-free.

Key Features of Roth 401(k):

- Contributions: Made with after-tax dollars, meaning you pay taxes on your contributions upfront.

- Tax Benefit: There is no immediate tax break for contributions, but you will benefit from tax-free growth and tax-free withdrawals in retirement.

- Withdrawals: As long as you meet certain criteria (like being 59½ or older and having held the account for at least 5 years), withdrawals are tax-free.

- No RMDs: Roth 401(k)s are also subject to RMDs starting at age 73, but you can convert your Roth 401(k) to a Roth IRA to avoid RMDs.

Traditional 401(k) vs Roth 401(k): Key Differences

To help you understand the main differences between Traditional 401(k) and Roth 401(k), let’s compare them side by side:

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Taxation of Contributions | Pre-tax (reduces current taxable income) | After-tax (no immediate tax break) |

| Tax on Withdrawals | Taxed as ordinary income in retirement | Tax-free if qualified (at least 59½ and 5 years) |

| Required Minimum Distributions | Yes, starting at age 73 | Yes, but can convert to Roth IRA to avoid |

| Ideal for | People who want a tax break now and expect to be in a lower tax bracket in retirement | People who expect to be in the same or higher tax bracket in retirement |

When to Choose a Traditional 401(k)

A Traditional 401(k) may be the right choice if you want to lower your current taxable income and enjoy a tax break now. This is particularly beneficial for individuals who:

- Are in a higher tax bracket now and expect to be in a lower tax bracket when they retire.

- Want to reduce their taxable income for the year by contributing to the 401(k).

- Expect to have a lower income in retirement, which means they may pay a lower tax rate on their withdrawals.

Example Scenario for Traditional 401(k):

If you are currently in a high tax bracket and expect your income to decrease in retirement, contributing to a Traditional 401(k) can help you reduce your taxable income today, and you’ll pay taxes on the withdrawals at a lower rate when you retire.

When to Choose a Roth 401(k)

A Roth 401(k) may be a better choice if you’re looking for tax-free withdrawals in retirement or if you expect to be in the same or a higher tax bracket when you retire. This is ideal for individuals who:

- Are currently in a lower tax bracket and want to benefit from tax-free growth and withdrawals in retirement.

- Expect their income to rise in the future, potentially putting them in a higher tax bracket when they retire.

- Want the flexibility of tax-free withdrawals in retirement, especially if they plan to retire early.

Example Scenario for Roth 401(k):

If you are currently in a low tax bracket and anticipate that your income (and tax bracket) will increase as you advance in your career, a Roth 401(k) allows your money to grow tax-free, and you won’t have to pay taxes when you take it out in retirement.

Tax Implications of Traditional 401(k) vs Roth 401(k)

Understanding the tax implications of each account type is crucial for long-term financial planning. Let’s break it down:

Traditional 401(k):

- Contributions are made with pre-tax dollars, which means you get an immediate tax deduction.

- Your taxable income for the year is reduced by the amount you contribute, lowering your current tax bill.

- However, when you start making withdrawals in retirement, you will be taxed on those withdrawals at your ordinary income tax rate.

Roth 401(k):

- Contributions to a Roth 401(k) are made with after-tax dollars, so there is no immediate tax break.

- Your taxable income is not reduced in the year you contribute, but your investment growth and qualified withdrawals in retirement are tax-free.

- This can be especially beneficial for those who expect to be in a higher tax bracket during retirement.

Which One Is Right for You?

The decision between Traditional 401(k) and Roth 401(k) depends largely on your current financial situation and future expectations. If you expect your tax rate to be lower in retirement, the Traditional 401(k) may be a better option. However, if you anticipate being in the same or a higher tax bracket in retirement, or if you value the ability to withdraw funds tax-free, the Roth 401(k) might be a more attractive option.

Key Takeaways:

- Traditional 401(k): Ideal for those who want a tax break now and expect to be in a lower tax bracket during retirement.

- Roth 401(k): Best for those who want tax-free growth and withdrawals in retirement and expect to be in the same or a higher tax bracket.

Conclusion

Both Traditional 401(k) and Roth 401(k) offer valuable tax advantages, but the right choice for you depends on your current tax situation and your expectations for the future. By understanding the key differences between these two accounts, you can make a decision that will help you optimize your retirement savings and tax strategy.

If you're still unsure which option is best for you, consider speaking with a financial advisor who can help you tailor your retirement plan to your specific needs and goals.