What Are 401(k) and Contribution Limits?

401(k) Plans

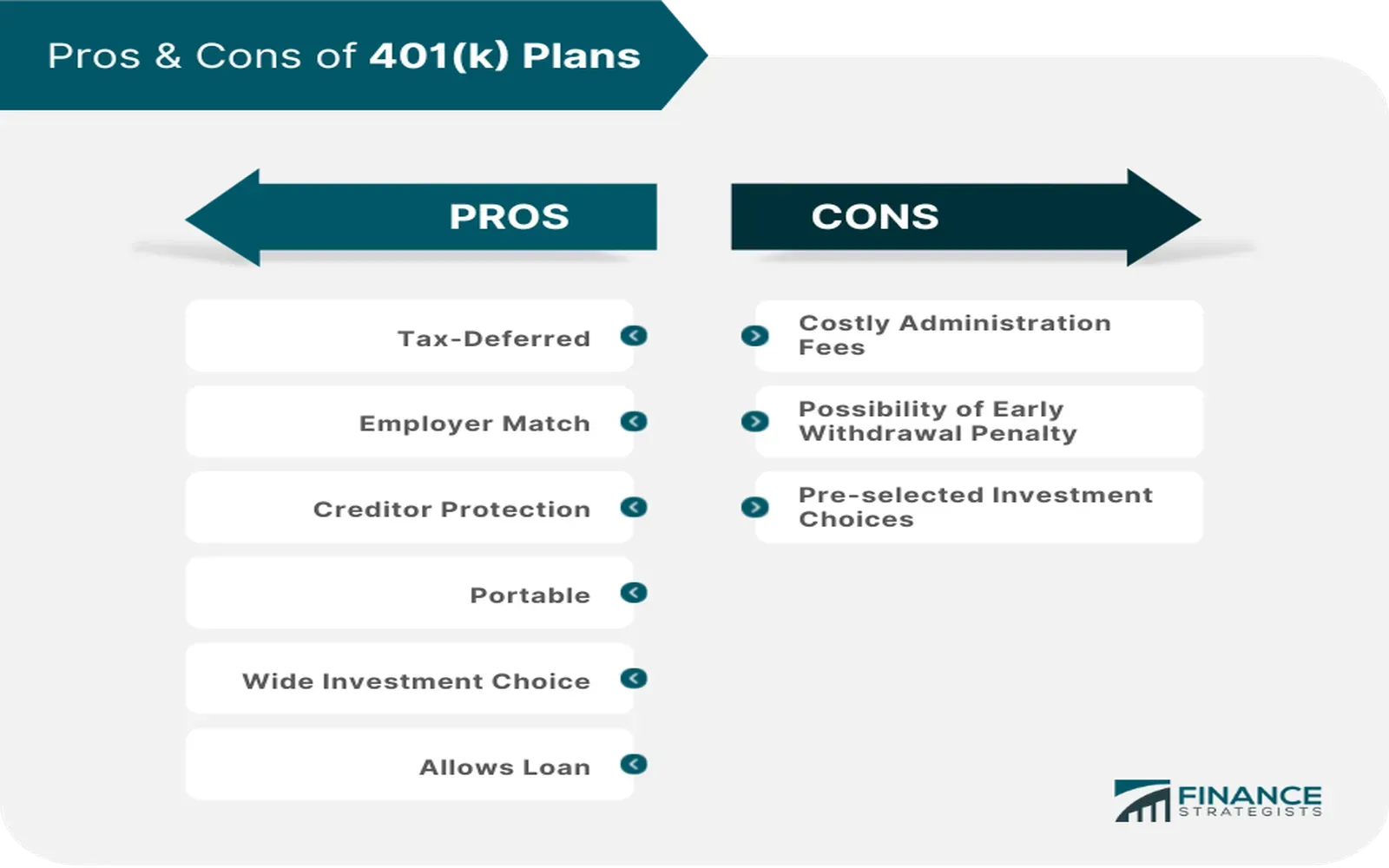

A 401(k) plan is a retirement savings program sponsored by employers that allows employees to contribute a portion of their pre-tax income into an investment account. The primary benefits include:

- Employee Contributions: Made with pre-tax dollars, reducing your taxable income for the year.

- Employer Matching: Many companies add a matching contribution, effectively boosting your retirement savings.

- Tax-Deferred Growth: Investments grow tax-deferred until withdrawal, maximizing the power of compounding over time.

This plan not only helps you save for retirement but also provides valuable tax advantages that can enhance your financial stability.

Contrbution Lmits

The 401(k) contribution limits are the maximum amounts you can contribute to your 401(k) retirement account each year. These limits are set by the IRS and are adjusted annually for inflation. Contributing up to these limits allows you to benefit from tax advantages, which are a significant reason why 401(k) plans are a popular choice for retirement savings.

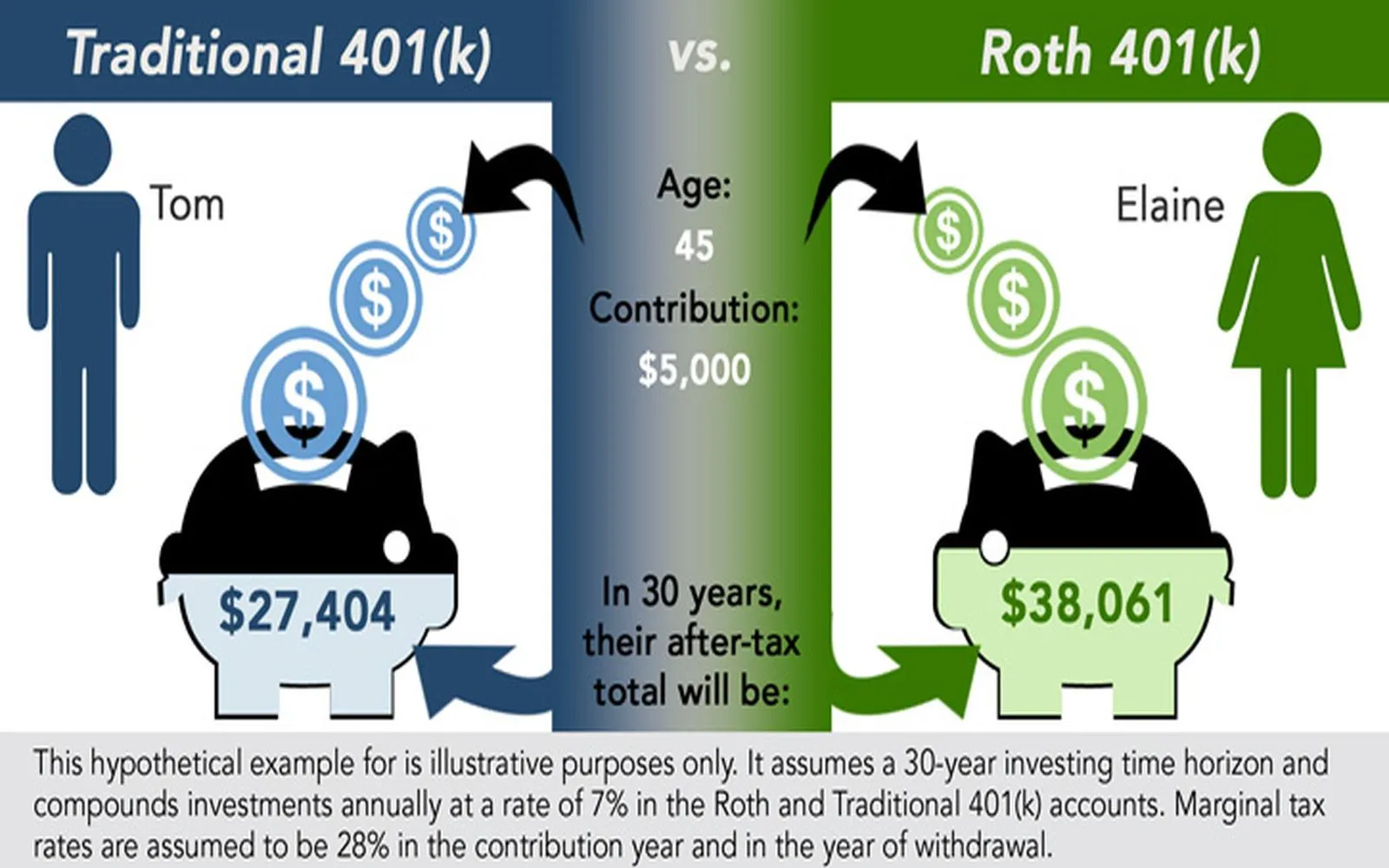

There are two main types of 401(k) plans: Traditional 401(k) and Roth 401(k). Both offer tax benefits, but in different ways. Traditional 401(k) contributions are made on a pre-tax basis, which lowers your taxable income in the year you make the contribution. Roth 401(k) contributions, on the other hand, are made with after-tax dollars, but your withdrawals in retirement are tax-free.

2025 Contribution Limits for Employees

For 2025, the IRS has increased the annual contribution limit for employees participating in a 401(k) plan. Here’s a breakdown of the key figures:

| Contribution Type | 2025 Limit |

|---|---|

| Employee Contribution | $22,500 |

| Catch-Up Contribution (50+) | $7,500 |

| Total Possible Contribution | $30,000 |

- For employees under 50, the maximum contribution is $22,500.

- For employees 50 and older, you can contribute an additional $7,500 in catch-up contributions, bringing the total possible contribution to $30,000.

These limits apply to both Traditional and Roth 401(k) plans, though the tax treatment of each is different, as explained below.

Employer Contributions: Understanding the Limits

In addition to the employee's own contributions, employers may also contribute to the employee’s 401(k). Employer contributions, such as matching contributions or profit-sharing, do not count toward the individual contribution limits but are subject to an overall annual limit.

For 2025, the total contribution limit—combining employee and employer contributions—is:

- $66,000 (for those under 50)

- $73,500 (for those 50 and older)

These limits include employee contributions, employer contributions, and any other employer-sponsored contributions. This total limit is significant, as it allows employees to grow their retirement savings faster with the help of their employers.

The Tax Benefits of Contributing to a 401(k)

One of the biggest advantages of a 401(k) is the tax benefits. There are two types of 401(k) plans, each offering different tax advantages:

Traditional 401(k): Tax-Deferred Growth

- Contributions: When you contribute to a Traditional 401(k), your contributions are made with pre-tax dollars, meaning you won’t pay taxes on them in the year you make the contribution.

- Tax Benefits: Your taxable income for the year will be reduced by the amount you contribute to the 401(k), which means you’ll owe less in income taxes for that year.

- Growth: The funds in your 401(k) grow tax-deferred, meaning you don’t pay taxes on the growth of your investments until you begin withdrawing them in retirement. This allows your investments to grow more quickly, as they are not reduced by annual tax payments.

- Withdrawals: When you retire and start withdrawing money from your 401(k), you will pay income tax on the withdrawals at your ordinary tax rate.

Roth 401(k): Tax-Free Growth

- Contributions: With a Roth 401(k), you make after-tax contributions, meaning you pay taxes on the money you contribute upfront.

- Tax Benefits: You won’t receive an immediate tax break for Roth contributions, but the big benefit comes when you withdraw funds in retirement.

- Growth: Your investment growth is tax-free, and because you paid taxes on the money you contributed upfront, you won’t have to pay taxes on the money you withdraw in retirement. This is especially beneficial if you expect to be in a higher tax bracket when you retire.

- Withdrawals: Qualified withdrawals from a Roth 401(k) are tax-free, allowing you to avoid paying taxes on your contributions and earnings when you take the money out in retirement.

How to Maximize Your 401(k) Contributions in 2025

Here are a few strategies to make the most of the 2025 401(k) contribution limits and maximize your tax benefits:

1. Max Out Your Employee Contribution

If possible, aim to contribute the full $22,500 (or $30,000 if you’re 50 or older) to your 401(k) in 2025. This will allow you to take full advantage of the tax-deferred growth in a Traditional 401(k) or the tax-free growth in a Roth 401(k).

2. Utilize Catch-Up Contributions

If you’re 50 or older, take advantage of the catch-up contribution. By contributing an additional $7,500, you can significantly increase your retirement savings and enjoy the same tax benefits as regular contributions.

3. Leverage Employer Matching Contributions

If your employer offers a matching contribution, be sure to contribute at least enough to receive the full match. Employer matching is essentially free money, helping you grow your retirement savings more quickly.

4. Consider Your Tax Bracket

If you expect to be in a lower tax bracket during retirement, a Traditional 401(k) may be a good choice, as you’ll benefit from tax deferral now and pay taxes at a lower rate later. If you expect to be in the same or a higher tax bracket in retirement, a Roth 401(k) could be the better option, allowing you to make tax-free withdrawals.

Rollover IRA: A Path to Flexibility

When changing jobs or transitioning into retirement, a Rollover IRA offers a streamlined way to consolidate your retirement funds:

- Expanded Investment Options: Unlike a 401(k), a Rollover IRA typically provides a wider range of investment choices, from stocks and bonds to mutual funds and ETFs.

- Simplified Account Management: Consolidating multiple 401(k) accounts into one Rollover IRA can make it easier to manage your overall portfolio.

- Continued Tax Advantages: Funds rolled over into an IRA remain tax-deferred, preserving the benefits you’ve built up over the years.

Utilizing a Rollover IRA ensures that your retirement savings remain flexible and accessible, providing you with more control over your investment strategy as your financial needs evolve.

Conclusion

The 2025 401(k) contribution limits provide excellent opportunities to boost your retirement savings while enjoying significant tax benefits. Whether you’re taking advantage of tax-deferred growth in a Traditional 401(k) or tax-free growth in a Roth 401(k), understanding the contribution limits and tax advantages is essential for effective retirement planning.

By maximizing your contributions, utilizing catch-up contributions (if eligible), and leveraging your employer’s matching program, you can significantly enhance your retirement savings and secure a comfortable financial future. Start planning today to make the most of these opportunities and ensure a well-funded retirement.