What Is Passive Income?

Passive income refers to money earned with minimal ongoing effort. Examples include:

- Rental property income

- Royalties from a book or digital product

- Affiliate marketing earnings

- Dropshipping or print-on-demand stores

- YouTube ad revenue or podcast sponsorships

What makes passive income attractive is its scalability—once set up, it can generate cash flow for years with limited maintenance.

What Is Passive Investment?

Passive investment, on the other hand, involves putting your money to work in the market with the goal of long-term capital appreciation. This includes:

- Investing in index funds and ETFs

- Dividend stocks

- REITs (Real Estate Investment Trusts)

- Robo-advisors

- Bonds and fixed-income securities

This method focuses on compound growth over time, relying on market performance and reinvestment strategies.

Key Differences Between Passive Income and Passive Investment

| Feature | Passive Income | Passive Investment |

|---|---|---|

| Effort to Start | High (requires setup time/skills) | Low (mainly financial input) |

| Ongoing Maintenance | Medium | Very Low |

| Income Potential | High (depending on business model) | Medium to High (depending on markets) |

| Risk Level | Medium to High (depending on niche) | Low to Medium (diversified portfolio) |

| Time to Generate Returns | 3-12 months (typical) | Long-term (5+ years ideal) |

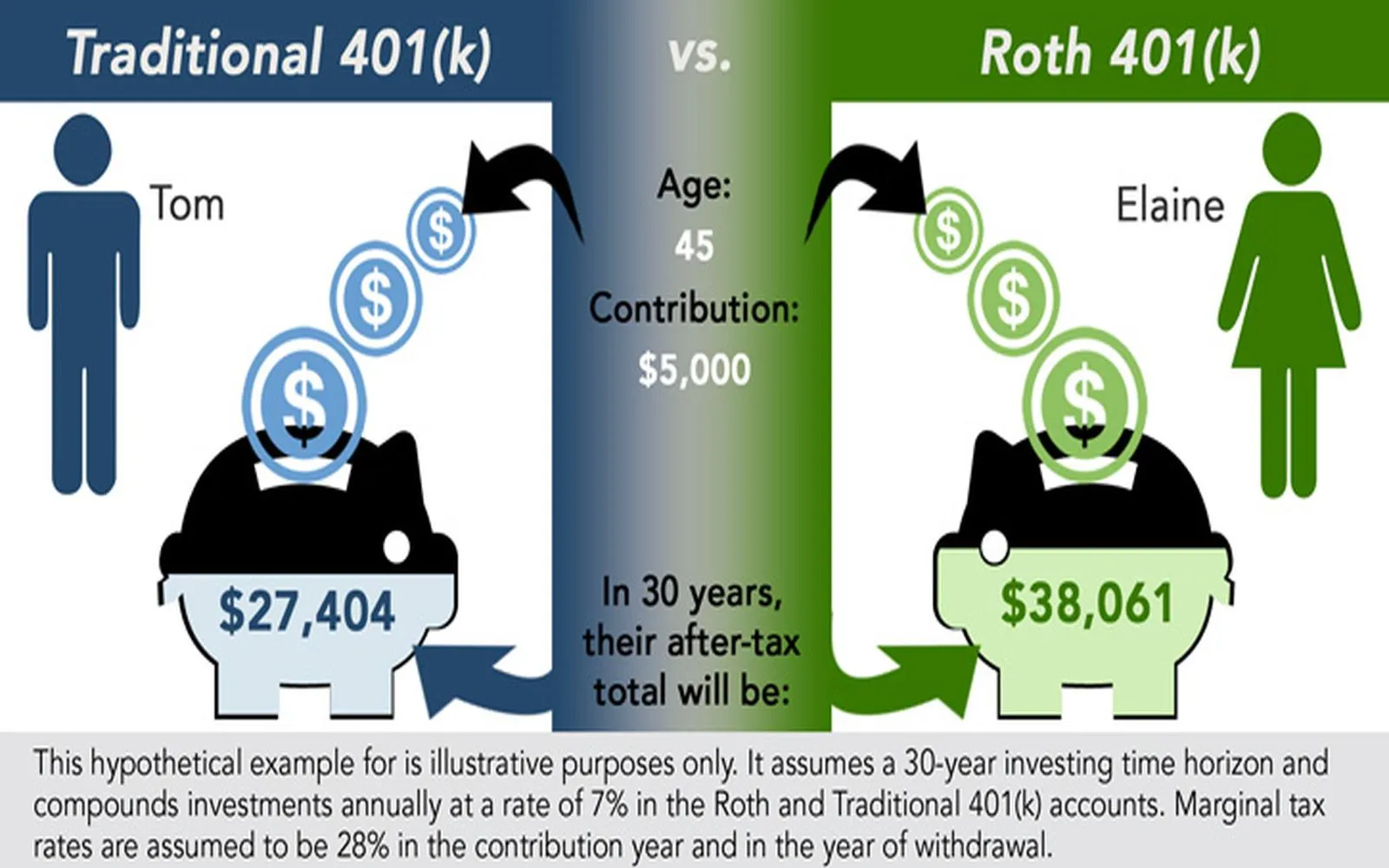

| Tax Treatment | Self-employment or business income | Capital gains, dividends, tax-advantaged |

Chart: Time vs. Wealth Accumulation

To help visualize how each strategy can perform over time, here’s a simplified chart based on typical returns.

📊 Projected Wealth Over 10 Years (Assumes $10,000 starting capital)

| Year | Passive Income (Reinvested) | Passive Investment (7% Annual Return) |

|---|---|---|

| 1 | $12,000 | $10,700 |

| 3 | $20,000 | $12,250 |

| 5 | $35,000 | $14,026 |

| 7 | $60,000 | $16,140 |

| 10 | $100,000+ | $19,671 |

Note: Passive income assumes a modest business generating $1,000/month net profit after 6 months. Passive investment assumes a buy-and-hold approach with reinvested dividends.

Which One Builds Wealth Faster?

If your goal is to accumulate wealth faster, passive income can outperform traditional investments in the short-to-mid term. For instance, launching an online course or rental property can start generating thousands per month within a year—whereas index funds may take a decade to double your money.

However, passive investments shine in low-risk, long-term wealth preservation, especially when automated. You don’t have to manage tenants or constantly create new content.

Combining Both for Maximum Wealth

Why choose one when you can leverage both?

- Use passive income to generate strong cash flow

- Funnel that cash into passive investments for long-term growth

- Diversify your income sources to reduce risk

This hybrid approach can accelerate your wealth-building timeline while providing financial security and freedom.

Final Thoughts

Passive income vs. passive investment doesn’t have to be an either/or decision. While passive income may offer faster returns, passive investment offers greater stability and less effort over time. The most successful wealth-builders often integrate both strategies, balancing risk, time, and effort for optimal growth.