Why Invest in Commodities in 2025?

Commodities are physical assets like gold, oil, and agricultural products that have intrinsic value. They typically perform well in inflationary environments, making them ideal for portfolio diversification.

Key Benefits of Commodity Investing:

- Hedge against inflation

- Low correlation with stocks and bonds

- Exposure to global economic trends

- High liquidity in futures and ETFs

Hottest Sectors: Top Commodities to Watch in 2025

Chart: Forecasted Growth of Key Commodities (2025)

| Commodity | Expected Return (%) | Key Driver |

|---|---|---|

| Gold | 8.5% | Inflation hedge, geopolitical risk |

| Copper | 12.3% | EV demand, infrastructure growth |

| Lithium | 15.0% | Battery production surge |

| Natural Gas | 6.7% | Global energy transition |

| Wheat | 7.2% | Food supply concerns |

Source: Bloomberg, World Bank, 2025 Projections

1. Gold – The Classic Safe-Haven Investment

Gold remains one of the top commodities to invest in 2025 due to its role as a store of value in uncertain times. With ongoing geopolitical unrest and potential central bank rate cuts, investors are flocking to precious metals.

Why Gold in 2025?

- Central banks are increasing gold reserves

- Strong demand for gold ETFs

- Rising retail interest during inflation spikes

Best way to invest: Gold ETFs (like GLD), gold mining stocks, or physical bullion.

2. Copper – The Backbone of the Green Revolution

The electrification of infrastructure is driving strong demand for copper. It’s used in electric vehicles (EVs), charging stations, and renewable energy systems.

Copper’s 2025 Bullish Factors:

- Global push toward decarbonization

- U.S. infrastructure spending programs

- Tight supply from major producers like Chile

Bold keyword: top industrial commodity for long-term gains

3. Lithium – Powering the EV Boom

No list of the top commodities to invest in 2025 is complete without lithium. As a core component in EV batteries, demand is expected to skyrocket with EV adoption across the U.S. and globally.

Highlights:

- Tesla and other automakers are expanding battery production

- Short-term price corrections have created buying opportunities

- ESG investing trend supports lithium mining innovation

Best exposure: Lithium ETFs (LIT), lithium mining stocks (e.g., Albemarle), or futures contracts.

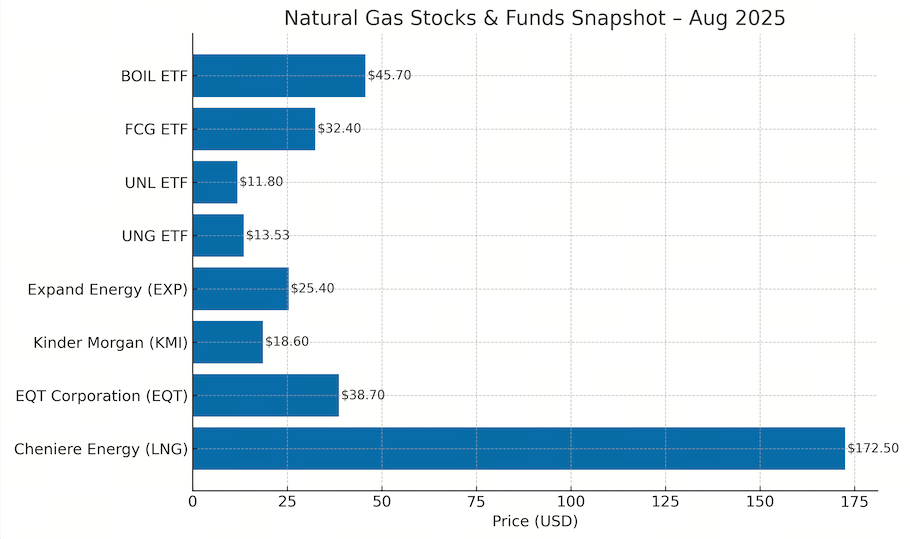

4. Natural Gas – Transition Fuel for the New Energy Era

While the world moves toward renewables, natural gas continues to serve as a bridge fuel due to its lower emissions compared to coal and oil.

Why Natural Gas Still Matters:

- Global LNG demand is growing

- Supply constraints due to geopolitical tensions

- Increased utility usage during heat waves and cold snaps

Investment vehicles: Natural gas ETFs (UNG), or futures contracts.

5. Wheat – Resilient Agricultural Investment

Agricultural commodities like wheat are gaining attention as food security becomes a global priority. Climate change, droughts, and supply chain issues are putting upward pressure on grain prices.

Why Consider Wheat in 2025:

- Unpredictable weather patterns

- Population growth and increased demand

- Export restrictions from major producers

Ways to invest: Commodity ETFs (WEAT), futures contracts, or agribusiness stocks.

Chart: Commodity ETF Performance (YTD 2025)

| ETF Symbol | Commodity Focus | YTD Performance (%) |

|---|---|---|

| GLD | Gold | +6.8% |

| LIT | Lithium | +10.4% |

| CPER | Copper | +8.7% |

| UNG | Natural Gas | +4.3% |

| WEAT | Wheat | +5.1% |

Performance as of May 2025. Source: Morningstar

How to Start Investing in Commodities

1. Use ETFs and Mutual Funds

These offer diversified exposure without the complexity of trading futures.

2. Trade Futures for Direct Exposure

Futures are ideal for advanced traders seeking higher leverage and direct commodity pricing.

3. Consider Stocks in Related Sectors

Mining, energy, and agriculture companies offer indirect commodity exposure.

Tips for Successful Commodity Investing

- Monitor macroeconomic indicators: Inflation, interest rates, and global demand.

- Diversify across multiple commodities to reduce risk.

- Stay updated on geopolitical events that impact supply chains.

- Understand the seasonality of agricultural products.

Final Thoughts: Positioning for Profit in 2025

With economic uncertainty and technological transformation ahead, 2025 is shaping up to be a pivotal year for commodity investments. From gold’s safe-haven appeal to the renewable boom fueling lithium and copper, now is the time to explore the top commodities to invest in.

By aligning your portfolio with global demand trends, you can protect your wealth and capitalize on long-term growth opportunities.