US Natural Gas Market Outlook for 2025

The U.S. natural gas sector is seeing renewed momentum thanks to global LNG demand, new trade agreements, and stable price trends. Recent deals with the EU and South Korea are expected to boost LNG exports, while increasing storage levels are helping reduce price volatility. This creates a favorable environment for both stock and ETF investors in 2025.

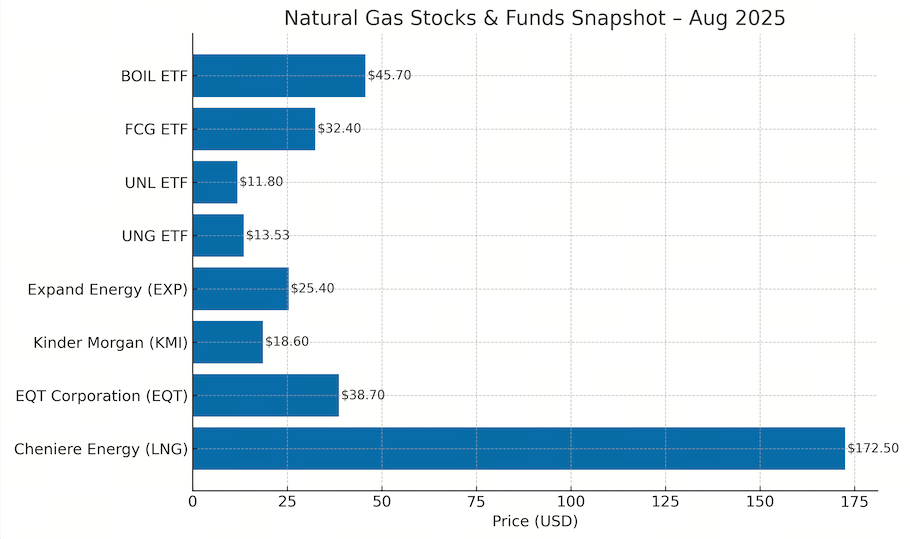

Natural Gas Stocks & Funds Snapshot – Aug 2025

| Asset Name | Symbol | Price (USD) | Notes |

|---|---|---|---|

| Cheniere Energy | LNG | $172.50 | Leading U.S. LNG exporter |

| EQT Corporation | EQT | $38.70 | Largest U.S. natural gas producer |

| Kinder Morgan | KMI | $18.60 | Major U.S. pipeline operator |

| Expand Energy | EXP | $25.40 | Large independent gas producer |

| United States Natural Gas Fund | UNG | $13.53 | Tracks short-term natural gas futures |

| United States 12-Month Fund | UNL | $11.80 | Long-term natural gas futures ETF |

| First Trust Natural Gas ETF | FCG | $32.40 | Equity-based natural gas ETF |

| ProShares Ultra Bloomberg Gas | BOIL | $45.70 | Leveraged ETF (high volatility) |

Market Snapshot

- United States Natural Gas Fund (UNG) – $13.53 per share, slight daily change (-0.07%).

- Exxon Mobil Corp. (XOM) – $105.95 per share, steady performance within weekly range.

- ConocoPhillips (COP) – $92.60 per share, moderate trading volume and healthy market cap.

These figures give a quick look at how key players and funds are performing as of early August 2025.

Leading Natural Gas Stocks to Watch

Cheniere Energy – A leading U.S. LNG exporter, Cheniere posted Q2 2025 net income of $1.63B, nearly double year-over-year. Strong global contracts and increased export capacity support future growth.

EQT Corporation – The largest natural gas producer in the Appalachian Basin, EQT is projected to grow earnings by over 100% in 2025, supported by acquisitions and rising demand from AI-driven data centers.

Kinder Morgan – Operating 40% of U.S. natural gas pipelines, Kinder Morgan provides stable income and infrastructure exposure.

Expand Energy – One of the largest independent natural gas producers, with over 20,800 Bcf of proved reserves across major shale regions.

Prominent Natural Gas–Focused ETFs & Funds

United States Natural Gas Fund (UNG) – Tracks natural gas prices via short-term futures. Known for its strong year-to-date gains in 2025, though it carries higher volatility.

United States 12-Month Natural Gas Fund (UNL) – Spreads investments across 12 months of futures contracts, reducing the effects of contango.

First Trust Natural Gas ETF (FCG) – Holds shares of major gas exploration and production companies, offering equity diversification instead of pure futures exposure.

ProShares Ultra Bloomberg Natural Gas (BOIL) – A leveraged ETF providing 2× daily exposure to natural gas price movements; suited only for experienced traders due to its high volatility.

Why These Investments Stand Out in 2025

- Global LNG expansion is boosting profits for exporters like Cheniere.

- Infrastructure control from companies like Kinder Morgan ensures steady revenue streams.

- Diverse ETF options let investors choose between commodity futures exposure (UNG, UNL) or equity-based strategies (FCG).

- Leveraged products like BOIL offer short-term trading potential but require careful risk management.

Suggested Allocation Example

- 30% – Cheniere Energy and EQT (growth-oriented producers)

- 25% – Kinder Morgan and Expand Energy (infrastructure stability)

- 25% – UNG or UNL (futures-based exposure)

- 15% – FCG (diversified equity ETF)

- 5% – BOIL (only for high-risk, short-term trades)

Final Thoughts: Strategic Energy Investing in 2025

The U.S. natural gas sector offers a mix of growth opportunities and defensive investments in 2025. With global LNG demand rising, stable pricing trends, and multiple accessible ETF options, investors can tailor their portfolios to match both risk tolerance and return goals.

Whether your strategy leans toward steady dividend income or capital appreciation, natural gas remains a strong contender for diversified energy portfolios this year.