Low Rate Credit Cards: Your Ally in Minimizing Interest Charges

Carrying a balance on your credit card can be costly, especially if you have a high interest rate. Low rate credit cards offer a solution, providing lower interest rates than traditional credit cards and helping you minimize interest charges.

But what exactly constitutes a best low rate credit card? Here are some key factors to consider:

Interest rate: Look for a card with a low ongoing APR. The lower the interest rate, the less you'll pay in interest charges.

Fees: Some low rate cards charge annual fees, while others don't. Consider whether the benefits of the card outweigh the annual fee.

Introductory offers: Some cards offer introductory 0% APR periods on purchases or balance transfers. This can be a valuable way to save money on interest, but be sure you can pay off the balance before the promotional period ends.

Rewards and benefits: Some low rate cards also offer rewards programs and other benefits, such as travel insurance or purchase protection.

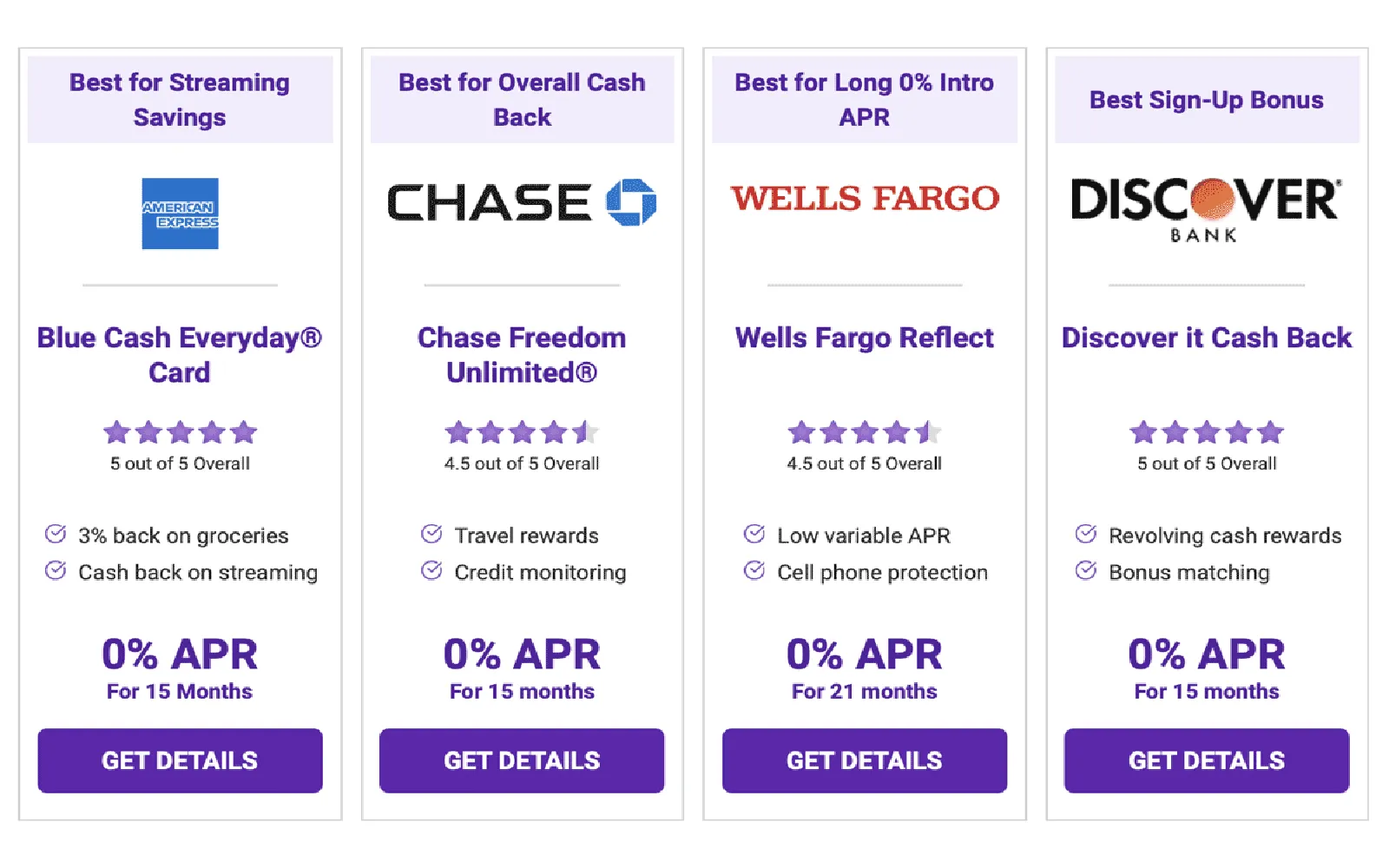

Several credit cards with low interest rates and rewards are available. The Wells Fargo Reflect® Card, for example, offers a low ongoing APR and an introductory 0% APR period on purchases and qualifying balance transfers. It also earns cash back rewards on every purchase.

If you're looking for the lowest credit card rate, you may need to consider a secured credit card. Secured cards require a security deposit, but they often have lower interest rates than unsecured cards.

It's important to note that the lowest credit card rates are typically reserved for individuals with good or excellent credit. If you have bad credit, you may still be able to qualify for a low rate card, but the interest rate will likely be higher.

Here are some tips for finding the best low interest rate credit cards:

Compare offers from different issuers: Don't just settle for the first offer you see. Compare interest rates, fees, and benefits from multiple issuers to find the best deal.

Check your credit score: Knowing your credit score will help you understand what kind of interest rates you can qualify for.

Consider a balance transfer: If you have existing credit card debt, you may be able to save money by transferring it to a low rate card with a 0% APR introductory offer on balance transfers.

Remember, low rate credit cards can be a valuable tool for saving money on interest and managing your debt more effectively. By choosing the right card and using it responsibly, you can keep your interest charges to a minimum and achieve your financial goals.