Poor Credit Credit Cards: Building a Brighter Financial Future

Having poor credit can make it difficult to qualify for traditional credit cards and loans. However, there are still options available, including poor credit credit cards. These cards can help you rebuild your credit score and gain access to the credit you need.

Business Credit Card Poor Credit:

There are a few business credit cards for poor credit available. These cards can help you separate your personal and business expenses, build business credit, and earn rewards. However, they may have higher interest rates and fees than traditional business credit cards.

Poor Credit Credit Cards:

Poor credit credit cards are designed for individuals with low credit scores or limited credit history. They typically have higher interest rates and fees than traditional credit cards, but they can be a valuable tool for building or rebuilding credit.

Credit Card Program for Fair/Poor Credit:

Some credit card issuers offer credit card programs specifically designed for people with fair or poor credit. These programs may offer lower interest rates and fees than traditional bad credit credit cards.

How to Establish Business Credit with Poor Personal Credit:

Establishing business credit with poor personal credit can be challenging, but it is possible. Here are a few tips:

Incorporate your business: This will help you separate your personal and business credit.

Get a business credit card: Secured business credit cards are a good option for people with poor credit.

Pay your bills on time: This is the most important factor in building good credit.

Monitor your credit score: You can track your progress and identify any potential issues.

Credit Cards for Very Poor Credit No Deposit:

There are a few unsecured credit cards for very poor credit available. However, these cards may have very high interest rates and fees. It's important to compare offers carefully and choose a card that you can afford to repay.

Department Store Credit Cards for Poor Credit:

Department store credit cards are often easier to qualify for than traditional credit cards, even if you have poor credit. However, they typically have high interest rates.

Retail Store Credit Cards for Poor Credit:

Retail store credit cards are similar to department store credit cards. They may be easier to qualify for, but they also typically have high interest rates.

Apply for Credit Card with Poor Credit:

You can apply for credit card with poor credit online or through a credit card issuer's website. Be prepared to provide some basic personal information and financial information, such as your income and housing expenses.

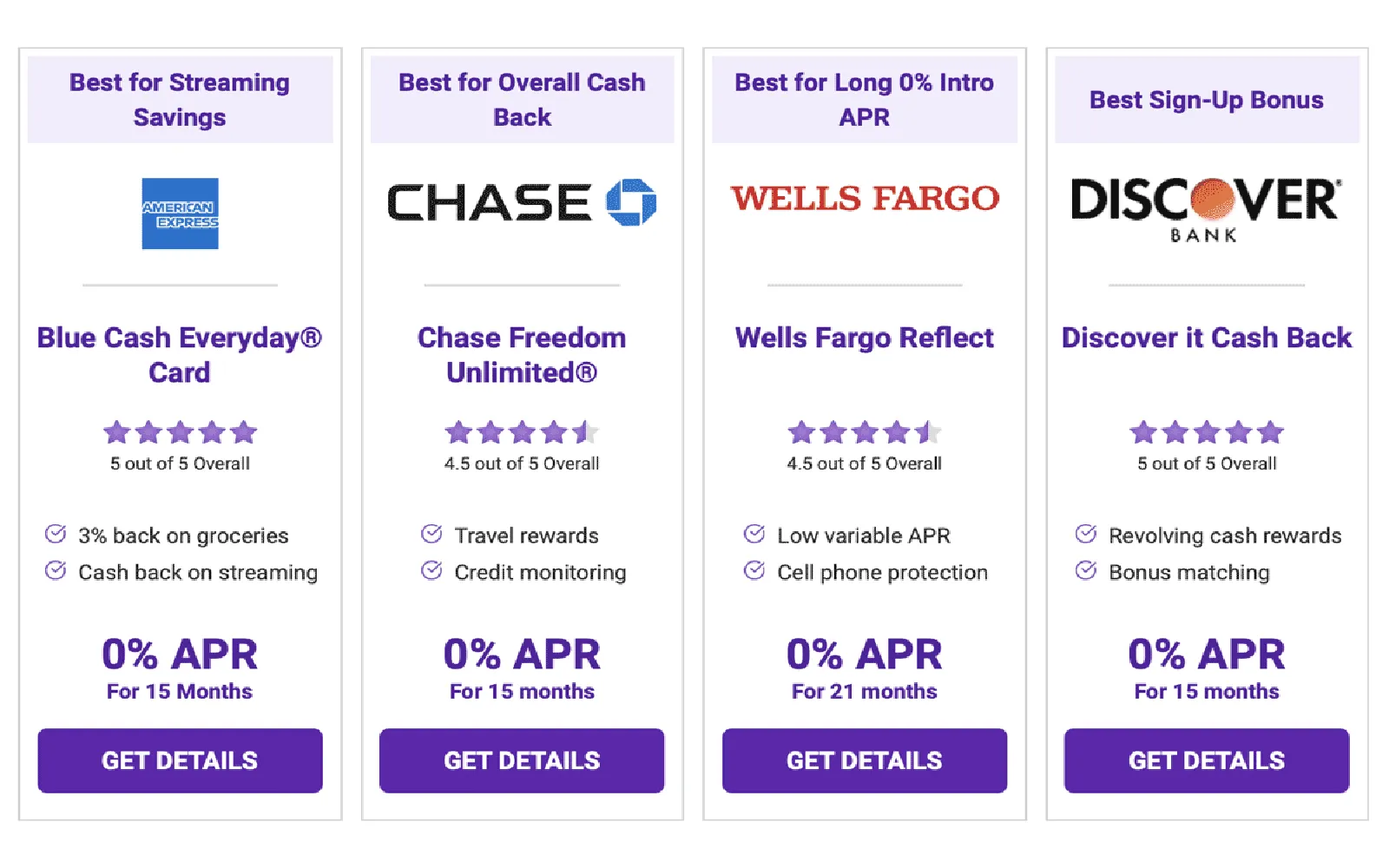

Best Credit Cards Rewards for Poor Credit:

There are a few credit cards for poor credit that offer rewards, such as cash back or points. However, these cards may have higher interest rates and fees than traditional rewards cards.

Credit Card Application Poor Credit:

When you apply for a credit card with poor credit, you may have a lower chance of approval. Be prepared to provide additional information to the issuer, such as proof of income or a cosigner.

Best Credit Card for Poor Credit:

The best credit card for poor credit will vary depending on your individual needs and preferences. Consider factors like the interest rate, fees, rewards program, and credit limit.

Balance Transfer Credit Cards for Poor Credit Rating:

Balance transfer credit cards for poor credit can help you consolidate debt and save money on interest charges. However, they may have higher balance transfer fees and interest rates than traditional balance transfer cards.

Best Balance Transfer Cards for Poor Credit:

The best balance transfer cards for poor credit will offer a low balance transfer fee and a long introductory 0% APR period. However, these cards may be difficult to qualify for.

Credit Card Balance Transfers for Poor Credit Instant:

Be wary of credit card balance transfers for poor credit instant approval. These offers may have high fees and interest rates, and they may not be the best option for your financial situation.

Remember, using a poor credit credit card responsibly can help you build your credit score and qualify for better credit products in the future.