0% APR Credit Cards

Many credit cards offer introductory 0% APR periods on purchases or balance transfers.

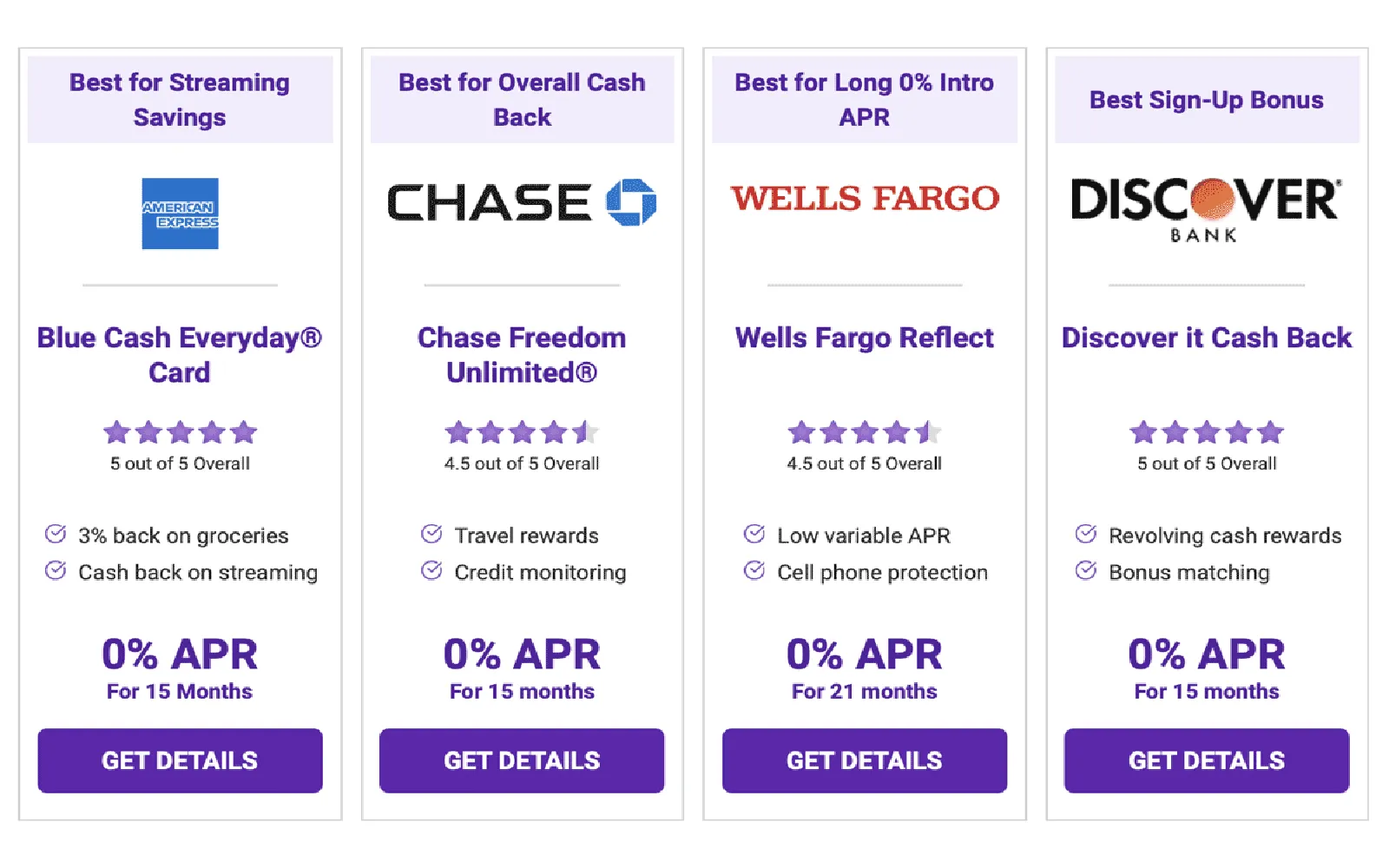

Some of the best 0% APR credit cards include:

- Wells Fargo Reflect® Card: Offers an introductory 0% APR for 21 months from account opening on purchases and qualifying balance transfers.

- Citi Simplicity® Card: Provides an introductory 0% APR for 21 months on balance transfers from date of first transfer (made within 4 months of account opening).

- Chase Freedom Flex℠: Offers an introductory 0% APR for 15 months on purchases and balance transfers made within 60 days of account opening.

Advantages of 0% interest credit cards & How you can make the most of these financial products

1.Interest-Free Financing:

The primary allure of 0% interest credit cards is the ability to finance purchases without incurring interest charges during the introductory period, which typically ranges from 6 to 21 months. This allows you to spread the cost of large purchases, such as home improvements or electronics, over several months without paying extra for interest. It’s an excellent way to manage cash flow and make necessary purchases without financial strain.

2.Debt Consolidation:

Many 0% interest credit cards offer 0% APR on balance transfers as well. This feature is particularly beneficial for individuals looking to consolidate high-interest debt. By transferring balances from high-interest credit cards to a 0% interest card, you can significantly reduce the amount you pay in interest and focus on paying down the principal balance faster. Be mindful of any balance transfer fees, which typically range from 3% to 5% of the transferred amount, and ensure the savings in interest outweigh these fees.

3.Accelerated Debt Repayment:

Utilizing a 0% interest credit card can accelerate your debt repayment process. With no interest accruing during the introductory period, every dollar you pay goes directly toward reducing your principal balance. This can help you eliminate debt more quickly and save money in the long run, as you avoid the compounding interest that can make debt repayment challenging.

4.Building or Rebuilding Credit:

Responsibly using a 0% interest credit card can positively impact your credit score. Making on-time payments and keeping your credit utilization low are crucial factors in maintaining a healthy credit profile. By demonstrating good credit habits with a 0% interest card, you can build or rebuild your credit score, which is essential for future financial opportunities, such as applying for a mortgage or auto loan.

5.Emergency Financial Flexibility:

Having a 0% interest credit card on hand provides financial flexibility in case of emergencies. Whether it’s unexpected medical expenses, car repairs, or other urgent needs, a 0% interest card allows you to address these situations without the immediate worry of interest charges. This can provide peace of mind and a buffer during financially stressful times.

6.Rewards and Perks:

Some 0% interest credit cards also offer rewards programs, such as cash back, points, or travel miles. By combining the benefits of interest-free financing with rewards, you can maximize the value of your spending. Look for cards that align with your spending habits and preferences to get the most out of your purchases.

Tips for Maximizing the Benefits of 0% Interest Credit Cards

1.Pay Attention to the Fine Print:

Understand the terms and conditions of the 0% interest offer, including the duration of the introductory period and any applicable fees, such as balance transfer fees or annual fees. Make sure you know what the interest rate will be after the introductory period ends to avoid surprises.

2.Make Timely Payments:

Always make at least the minimum payment on time to avoid late fees and potential loss of the 0% interest benefit. Setting up automatic payments can help ensure you never miss a due date.

3.Plan for the End of the Introductory Period:

Create a repayment plan that allows you to pay off the balance before the introductory period ends. This will help you avoid reverting to a higher interest rate and maximize the interest-free benefit.

4.Avoid New Debt:

Use the 0% interest period to pay down existing debt rather than accruing new debt. This will help you improve your financial position and take full advantage of the interest savings.

Conclusion

0% interest credit cards offer a range of benefits that can help you manage your finances more effectively. From interest-free financing and debt consolidation to building credit and providing financial flexibility, these cards can be a valuable tool when used responsibly. By understanding the terms, making timely payments, and planning your repayment strategy, you can maximize the benefits of a 0% interest credit card and achieve your financial goals.