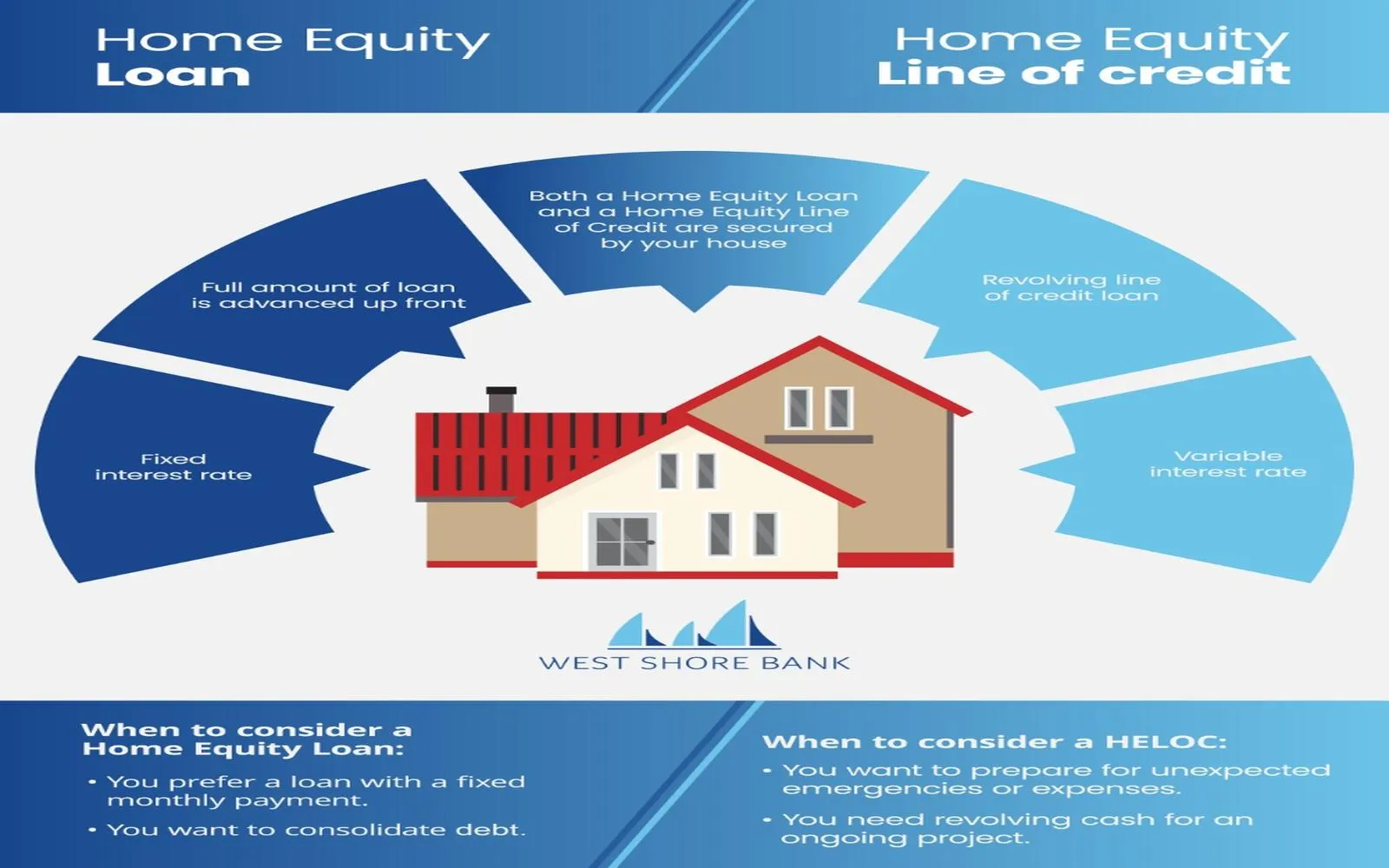

If you're a homeowner looking to leverage the equity in your property, exploring a Home Equity Line of Credit (HELOC) could be a wise financial move. HELOCs offer flexible borrowing options secured against the value of your home, providing access to funds for various needs, from home improvements to debt consolidation. Here’s everything you need to know to make an informed decision about tapping into your home equity.

Understanding HELOC: What Is It and How Does It Work?

A Home Equity Line of Credit (HELOC) functions similarly to a credit card in that it allows you to borrow funds up to a predetermined credit limit, using your home as collateral. The amount you can borrow is determined by the equity you have in your home—the difference between its current market value and the outstanding balance on your mortgage.

Benefits of HELOC

HELOCs offer several advantages, including:

- Flexibility: Borrow as much or as little as you need, up to your credit limit.

- Lower Interest Rates: Typically lower than credit cards or personal loans because they are secured by your home.

- Tax Deductibility: In many cases, the interest paid on a HELOC may be tax-deductible (consult a tax advisor for details).

Apply For Home Equity Loan Online: Steps to Getting Started

- Evaluate Your Needs: Determine how much equity you can access and what you intend to use it for.

- Research Lenders: Compare rates, terms, and customer reviews from different online home equity loan providers.

- Prequalification: Many lenders offer a prequalification process that gives you an estimate of how much you can borrow and at what rate.

- Application Process: Once you’ve chosen a lender, complete the application process online. You’ll need to provide financial information and details about your home.

- Approval and Funding: Upon approval, funds are typically accessible either through a check or a transfer to your bank account.

Conclusion

Securing a HELOC can be a strategic financial move, providing you with access to funds at competitive rates and flexible terms. Whether you're looking to renovate your home, consolidate debt, or finance a major purchase, exploring online home equity loan options can help you find the best solution for your needs. Take the time to compare offers, understand the terms, and choose a lender that fits your financial goals.

By tapping into your home equity wisely, you can secure your future and achieve your financial objectives with confidence. Apply for a home equity loan online today and take control of your financial future.