Unlocking the value of your home through an equity loan can be a smart financial move, offering access to funds for various needs such as home renovations, debt consolidation, or major purchases. In this comprehensive guide, we'll walk you through the process in five simple steps, providing you with the knowledge and tools needed to secure the best possible terms.

| Category | Explanation |

|---|---|

| Home Equity Loan Calculator | A home equity loan calculator helps you estimate your potential loan amount and monthly payments based on your home’s current value, outstanding mortgage balance, interest rate, and loan-to-value ratio (LTV). |

| Interest Rate | The interest rate is the percentage charged on the loan amount, which is determined by factors such as your credit score, loan amount, and market conditions. It is used to calculate the cost of borrowing. |

| Loan-to-Value Ratio (LTV) | The LTV ratio is calculated by dividing the total mortgage amount (including the home equity loan) by the appraised value of your home, expressed as a percentage. The formula is: LTV = (Mortgage Amount / Appraised Value) * 100. |

| Loan Amount | The loan amount is the money you can borrow, which is typically a percentage of your home equity. It is calculated by subtracting your current mortgage balance from a percentage (usually up to 85%) of your home's appraised value. The formula is: Loan Amount = (Appraised Value * Percentage) - Current Mortgage Balance. |

Example of Calculations:

- Appraised Home Value: $400,000

- Current Mortgage Balance: $250,000

- Interest Rate: 5%

- Desired LTV: 80%

- Calculate Maximum Loan Amount:Percentage of Home Value: 80%Maximum Loan Amount: ($400,000 * 80%) - $250,000 = $320,000 - $250,000 = $70,000

- Calculate LTV Ratio:LTV Ratio: ($320,000 / $400,000) * 100 = 80%

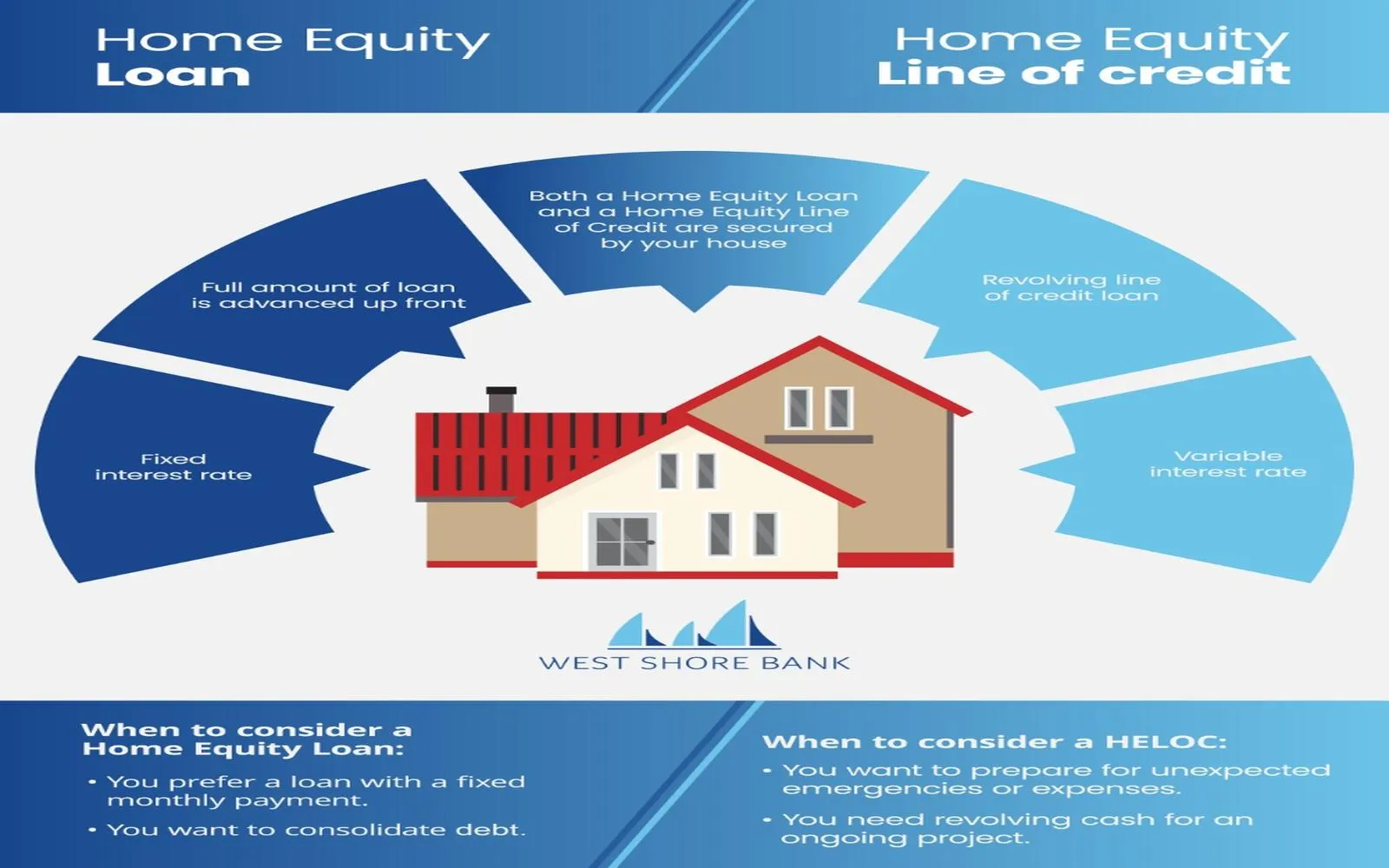

Step 1: Understand Home Equity Loans and Lines of Credit

Before diving into the application process, it's crucial to understand what a home equity loan and a line of credit entail.

What Is An Equity Line Of Credit?

An equity line of credit, often referred to as a HELOC, is a revolving line of credit that allows homeowners to borrow against the equity in their home. Unlike a traditional loan, you can draw from this line of credit as needed, up to the approved limit, and only pay interest on the amount you use.

Home Equity Loans

A home equity loan, on the other hand, is a lump sum loan where the borrower receives the entire loan amount upfront and repays it over a set term with fixed monthly payments. These loans typically have fixed interest rates, providing predictability in your monthly payments.

Step 2: Evaluate Your Financial Situation

To determine if a home equity loan or line of credit is the right choice for you, assess your current financial situation and needs.

Calculate Your Home Equity

Your home equity is the difference between your home's current market value and the outstanding balance on your mortgage. You can use a Home Equity Mortgage Calculator to estimate your available equity. This is a crucial step as it influences how much you can borrow.

Review Your Credit Score

Lenders will review your credit score as part of the application process. A higher credit score can qualify you for better Line Of Equity Rates and Current Home Equity Loan Fixed Rates. It's advisable to check your credit report and address any issues before applying.

Consider Your Debt-to-Income Ratio

Lenders also consider your debt-to-income (DTI) ratio, which is the percentage of your monthly income that goes toward debt payments. A lower DTI ratio increases your chances of approval and may help you secure more favorable loan terms.

Step 3: Research and Compare Lenders

Not all lenders offer the same terms or products, so it's essential to shop around.

Compare Line Of Equity Rates and Fixed Rates

Research various lenders to find the best Line Of Equity Rates and Current Home Equity Loan Fixed Rates. Websites like Discover Home Equity Loans and American Financing Home Equity Loan offer competitive rates and terms.

Look for Specialized Loans

If you're a veteran, you might qualify for a VA Home Equity Loan, which can offer favorable terms. Always inquire about any specialized loan programs that you might be eligible for.

Use Online Tools

Utilize online tools like the Home Equity Mortgage Calculator to compare different loan options based on your unique situation. These calculators can help you understand potential monthly payments and the total cost of the loan over time.

Step 4: Gather Necessary Documentation

When applying for a home equity loan or line of credit, you'll need to provide various documents.

Proof of Income

Lenders require proof of income to ensure you can repay the loan. This can include pay stubs, tax returns, and other financial statements.

Property Information

You'll need to provide information about your property, including its current market value. An appraisal may be required to determine this value accurately.

Personal Identification

Ensure you have up-to-date personal identification documents, such as a driver's license or passport, ready for submission.

Step 5: Submit Your Application and Close the Loan

Once you've gathered all necessary documentation and chosen a lender, you're ready to submit your application.

Application Process

The application process typically involves filling out forms and submitting your documentation. Be prepared to answer any follow-up questions from the lender.

Approval and Closing

Upon approval, you'll go through a closing process similar to when you first purchased your home. This includes signing the loan documents and paying any closing costs. Once completed, you can access your funds.

Managing Your Loan

After closing, it's essential to manage your loan responsibly. For a 30 Year Home Equity Loan, ensure you make timely payments to avoid penalties and maintain a good credit standing.

Additional Tips and Considerations

Monitor Interest Rates

Interest rates can fluctuate, so it's wise to keep an eye on trends. You might find opportunities to refinance your home equity loan for better rates through Home Equity Refinance options.

Understand Fees and Costs

Be aware of any fees associated with your loan, such as origination fees, appraisal fees, and closing costs. These can add up, so factor them into your overall cost calculations.

Seek Professional Advice

If you're unsure about any aspect of securing a home equity loan or line of credit, consider consulting a financial advisor. They can provide personalized advice based on your financial situation and goals.

Explore All Options

Before committing to a home equity loan, explore all available options, including the Best Home Equity Line offers. Different products and terms might better suit your needs and financial goals.

Conclusion

Securing an equity loan can be a strategic way to unlock your home's value and access the funds you need. By understanding the types of loans available, evaluating your financial situation, researching lenders, gathering the necessary documentation, and carefully managing the application process, you can navigate this journey with confidence. Utilize tools like the Home Equity Mortgage Calculator and stay informed about Current Home Equity Loan Fixed Rates to make the best decision for your financial future. Whether you're considering a VA Home Equity Loan, exploring options through Discover Home Equity Loans, or looking into American Financing Home Equity Loan, the key is to be informed and prepared.