One of the most effective ways to achieve this is through leveraging advanced retirement planning software. This article explores some of the best retirement planning solutions available, their features, and how they can benefit both individuals and financial advisors.

Understanding Retirement Planning Software

Retirement planning software serves as a comprehensive tool that assists individuals in forecasting and managing their finances post-retirement. Whether you're planning for personal use or seeking professional advice, these tools offer functionalities ranging from income projections to tax optimization and social security planning. Let's delve into some of the leading options in this domain:

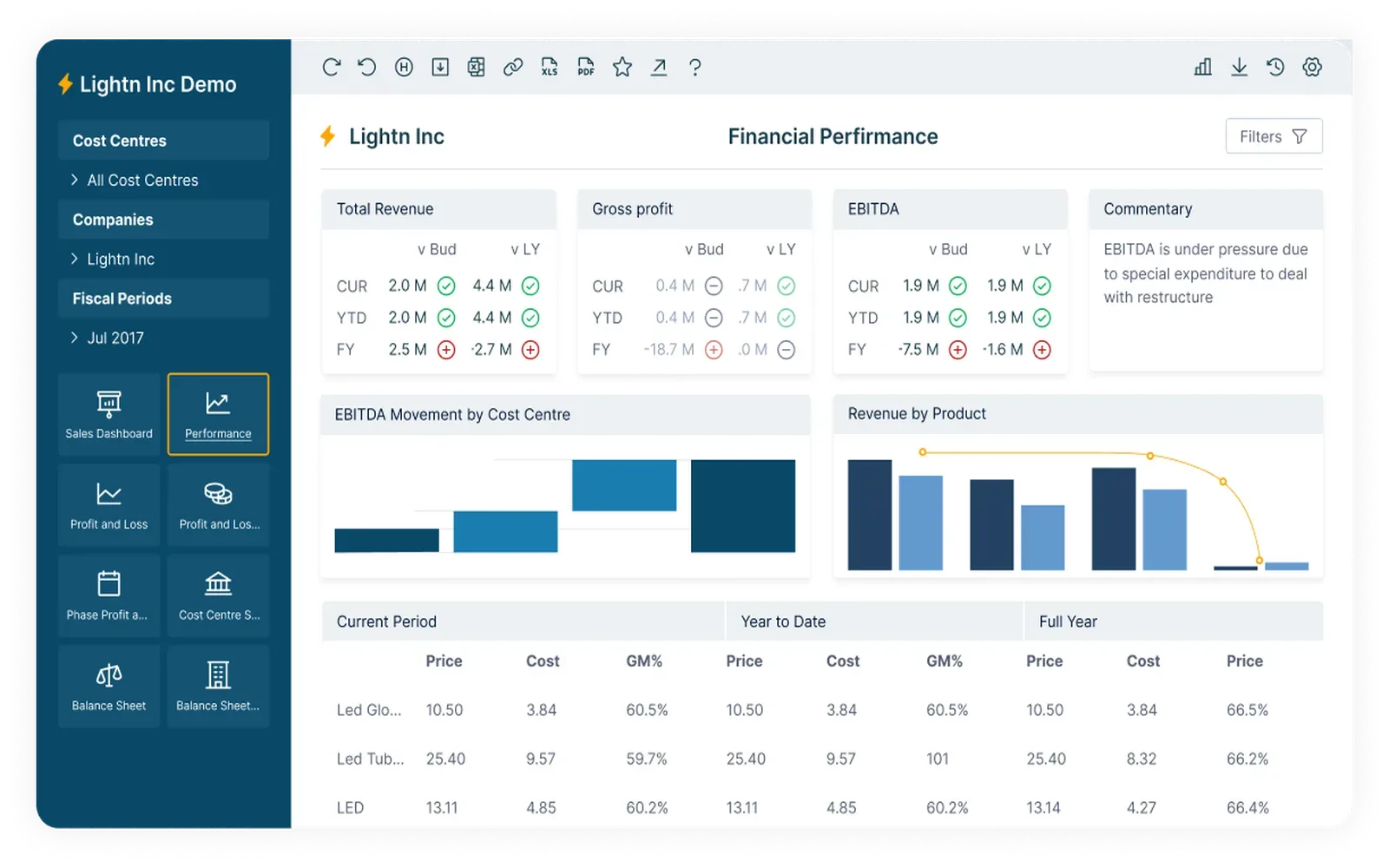

Wealthtrace Retirement Planning Software

Wealthtrace stands out as a robust option for both individuals and advisors alike. Its intuitive interface allows users to input various financial data points, including retirement goals, current savings, expected income streams, and desired lifestyle expenses. The software then generates detailed projections, highlighting potential gaps or excesses in savings based on different scenarios and market conditions. Wealthtrace also integrates sophisticated tax planning features, helping users optimize their retirement income by minimizing tax liabilities.

Comparing Free Retirement Planning Software Options

For those exploring cost-effective solutions, free retirement planning software offers a viable starting point. While these tools may lack some of the advanced features of their paid counterparts, they still provide essential functionalities such as basic income projections and savings estimations. Examples include simple calculators available on financial websites, which allow users to input data and receive a rudimentary retirement savings plan.

Social Security and Retirement Income Planning

Effective retirement planning goes beyond savings alone; it involves optimizing other income streams such as Social Security benefits. Dedicated social security planning software helps users maximize their entitlements by analyzing various claiming strategies based on individual circumstances. These tools consider factors like age, marital status, and expected lifespan to recommend optimal claiming times, ensuring retirees receive the maximum benefits available to them.

Professional and Open Source Solutions

For financial advisors and institutions, professional retirement planning software offers comprehensive features tailored to client management and portfolio analysis. These tools integrate advanced reporting capabilities, risk assessment models, and compliance tracking, streamlining the advisory process and enhancing client satisfaction.

On the other hand, open source retirement planning software provides flexibility and customization options for tech-savvy users and developers. These platforms allow for community-driven enhancements and modifications, catering to specific needs and evolving regulatory requirements in the retirement planning landscape.

Choosing the Best Retirement Planning Tool

Selecting the right retirement planning software depends on individual needs, financial goals, and comfort levels with technology. Factors to consider include:

- Usability and Interface: Intuitive navigation and user-friendly design can significantly impact the software's effectiveness.

- Features and Customization: Assess whether the software offers the necessary tools for comprehensive retirement income planning, including investment simulations and estate planning.

- Security and Support: Ensure the software adheres to industry standards for data security and offers reliable customer support.

Conclusion

In conclusion, leveraging advanced retirement planning software is essential for future-proofing your finances. Whether you're an individual planning for retirement or a financial advisor guiding clients through complex financial landscapes, choosing the right tool can make a significant difference. From Wealthtrace's detailed projections to the flexibility of open source solutions, there's a retirement planning software option to suit every need. By incorporating these tools into your financial strategy, you can achieve peace of mind knowing that your retirement goals are well within reach.

Investing in the best retirement planning software today ensures a stable and prosperous tomorrow. Start exploring your options and take charge of your financial future with confidence.