Whether you're an individual tracking personal expenses, a small business owner optimizing your finances, or an investment enthusiast managing your portfolio, the right financial planning software can make a significant difference. This article will guide you through various types of financial planning software, helping you find the best solution to achieve financial success.

Understanding Financial Planning Software

Financial planning software is a powerful tool designed to assist individuals and businesses in managing their financial affairs. From budgeting and forecasting to investment management and financial projections, these software solutions offer a wide range of functionalities. Let’s explore some key categories and the best options available within each.

Best Financial Planning Software for Individuals

When it comes to managing personal finances, having a reliable financial planning tool is essential. Here are some top choices:

1. Quicken

Quicken is one of the most well-known names in personal finance. It offers a comprehensive suite of tools for budgeting, investment tracking, and bill management. Quicken is user-friendly and provides a holistic view of your financial health, making it a top choice for individuals.

2. Personal Capital

Personal Capital is an excellent option, particularly for those focused on investment management. It offers a combination of free financial planning software and paid advisory services. The platform excels in tracking investments and providing detailed insights into your financial portfolio.

3. Mint

Mint, a free financial planning software, is ideal for budget-conscious individuals. It allows users to track spending, create budgets, and monitor financial goals. Mint's intuitive interface and comprehensive features make it a popular choice for personal finance management.

Financial Planning Software for Small Businesses

Small business owners require specialized tools to manage their finances effectively. Here are some of the best options:

1. QuickBooks

QuickBooks is the best financial planning software for small businesses. It offers robust features for accounting, invoicing, payroll, and expense tracking. QuickBooks’ seamless integration with various financial institutions and its user-friendly interface make it a top choice for small business owners.

2. Xero

Xero is a cloud-based financial planning software for businesses that need a comprehensive accounting solution. It offers features such as invoicing, payroll, expense tracking, and financial reporting. Xero is known for its ease of use and scalability, making it suitable for growing businesses.

3. FreshBooks

FreshBooks is an excellent option for service-based small businesses. It provides tools for time tracking, invoicing, expense management, and financial reporting. FreshBooks’ simple and intuitive design makes it easy for small business owners to manage their finances efficiently.

Best Budget Planning Software

Effective budgeting is crucial for both individuals and businesses. Here are some of the best budget planning software options available:

1. YNAB (You Need A Budget)

YNAB is a popular choice for personal budgeting. It follows a unique approach that encourages users to allocate every dollar to a specific purpose. YNAB’s methodology helps individuals gain control over their finances and save more money.

2. Tiller Money

Tiller Money is a budgeting tool that uses spreadsheets to track your finances. It automatically updates your financial data in Google Sheets or Microsoft Excel, allowing for a high level of customization. Tiller Money is ideal for those who prefer a more hands-on approach to budgeting.

3. PocketGuard

PocketGuard is a user-friendly budget planning software that helps you track your spending, create budgets, and save money. Its “In My Pocket” feature shows you how much disposable income you have after accounting for bills and savings goals.

Best Financial Planning Software for Businesses

Larger businesses and corporations require more advanced financial planning solutions. Here are some top contenders:

1. Adaptive Insights

Adaptive Insights is the best financial planning software for business due to its robust forecasting, budgeting, and reporting capabilities. It allows businesses to create detailed financial models and scenarios, providing valuable insights for decision-making.

2. Planful

Planful (formerly Host Analytics) offers a comprehensive suite of tools for financial planning and analysis (FP&A). It is designed to help businesses streamline their budgeting, forecasting, and reporting processes. Planful is known for its scalability and ease of use.

3. Anaplan

Anaplan is a powerful financial planning software that offers advanced modeling and planning capabilities. It is suitable for large enterprises that require a high level of customization and integration with other business systems. Anaplan’s flexibility and collaborative features make it a top choice for complex financial planning needs.

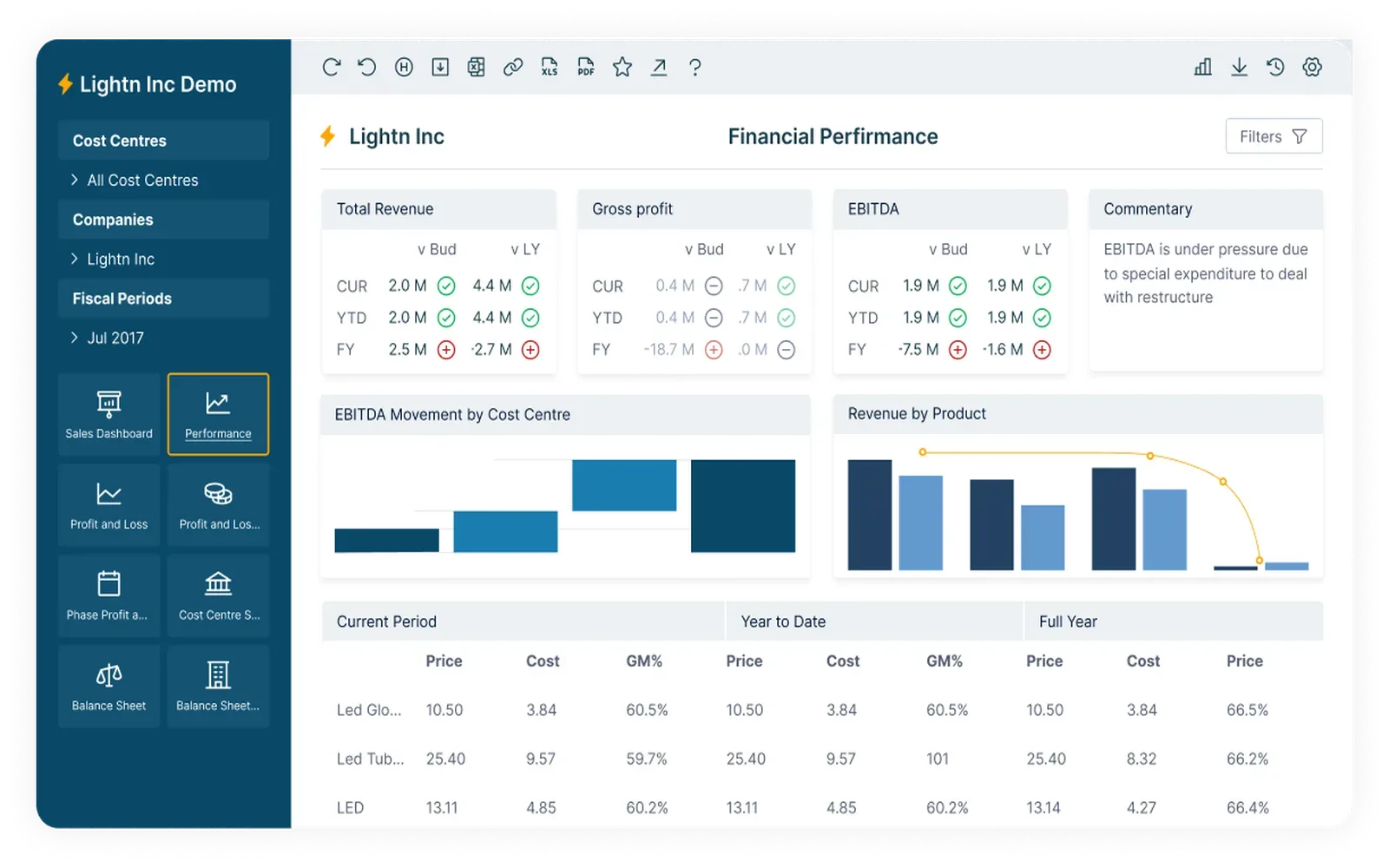

Best FP&A Software

Financial Planning and Analysis (FP&A) software is essential for organizations looking to improve their financial performance. Here are some of the best FP&A software options:

1. Workday Adaptive Planning

Workday Adaptive Planning is renowned for its user-friendly interface and powerful planning capabilities. It allows businesses to create detailed financial plans, forecasts, and reports, enabling better decision-making and strategic planning.

2. Board

Board is an all-in-one decision-making platform that combines FP&A, business intelligence, and predictive analytics. It helps businesses streamline their planning processes and gain deeper insights into their financial performance.

3. Prophix

Prophix offers comprehensive FP&A software that includes budgeting, forecasting, reporting, and analytics. Its user-friendly interface and robust features make it a popular choice for mid-sized to large organizations.

DIY Financial Planning Software

For those who prefer a hands-on approach to financial planning, DIY financial planning software offers the flexibility and control needed to manage finances effectively. Here are some top picks:

1. Moneydance

Moneydance is a comprehensive personal finance manager that offers features for budgeting, investment tracking, and bill payment. It supports multiple currencies and is suitable for individuals who want a detailed view of their financial health.

2. AceMoney

AceMoney is a simple yet powerful DIY financial planning software. It provides tools for budgeting, tracking investments, and managing expenses. AceMoney’s straightforward interface makes it easy for users to stay on top of their finances.

3. GnuCash

GnuCash is a free, open-source financial planning software that offers features for personal and small business accounting. It includes double-entry accounting, budgeting, and investment tracking, making it a versatile choice for DIY financial planners.

Best Personal Finance Software

Managing personal finances effectively requires reliable software. Here are some of the best personal finance software options:

1. You Need A Budget (YNAB)

As mentioned earlier, YNAB is a top choice for personal budgeting. Its proactive approach helps users take control of their finances and achieve their financial goals.

2. Quicken

Quicken’s comprehensive suite of tools makes it a top choice for personal finance management. It offers features for budgeting, investment tracking, and bill management, providing a holistic view of your financial health.

3. Personal Capital

Personal Capital combines free financial planning tools with paid advisory services. It excels in tracking investments and providing detailed insights into your financial portfolio, making it a valuable tool for personal finance management.

Best Portfolio Management Software

Investment enthusiasts and professionals require robust portfolio management software to track and optimize their investments. Here are some top options:

1. Morningstar Direct

Morningstar Direct is a powerful portfolio management software that offers advanced tools for investment research, portfolio analysis, and performance reporting. It is ideal for investment professionals and financial advisors.

2. E*TRADE

E*TRADE offers a comprehensive suite of tools for portfolio management, including investment tracking, performance analysis, and risk management. It is suitable for both individual investors and financial professionals.

3. Altruist

Altruist is a modern portfolio management platform designed for financial advisors. It offers features for investment management, performance reporting, and client communication, making it a valuable tool for advisory firms.

Financial Projection Software

Accurate financial projections are essential for long-term planning and decision-making. Here are some of the best financial projection software options:

1. Adaptive Insights

Adaptive Insights is a top choice for financial projection software due to its robust forecasting and modeling capabilities. It allows businesses to create detailed financial projections and scenarios, providing valuable insights for strategic planning.

2. Jirav

Jirav offers comprehensive financial projection software that includes features for budgeting, forecasting, and reporting. Its user-friendly interface and powerful analytics make it a popular choice for businesses of all sizes.

3. Prophix

Prophix’s financial projection software helps businesses create accurate financial forecasts and models. Its intuitive design and robust features make it a valuable tool for long-term financial planning.

Budget Planning Software for Business

Effective budgeting is crucial for business success. Here are some of the best budget planning software options for businesses:

1. PlanGuru

PlanGuru is a powerful budget planning softwarethat offers tools for budgeting, forecasting, and financial analysis. It is suitable for small to mid-sized businesses and provides valuable insights for decision-making.

2. Float

Float is a budget planning software designed for small businesses. It offers features for cash flow forecasting, budgeting, and financial reporting. Float’s user-friendly interface and integration with accounting software make it a top choice for business owners.

3. Scoro

Scoro is an all-in-one business management software that includes budget planning, project management, and financial reporting tools. Its comprehensive suite of features makes it ideal for businesses looking to streamline their operations and improve financial planning.

Conclusion

Finding the best financial planning software can significantly impact your financial success. Whether you’re an individual seeking to manage personal finances, a small business owner optimizing financial operations, or a large enterprise requiring advanced financial planning tools, there is a solution tailored to your needs. From the best investment management software to budget planning software for businesses, the right financial planning tool can help you pave your way to financial success and achieve your financial goals.