What Is Debt Consolidation?

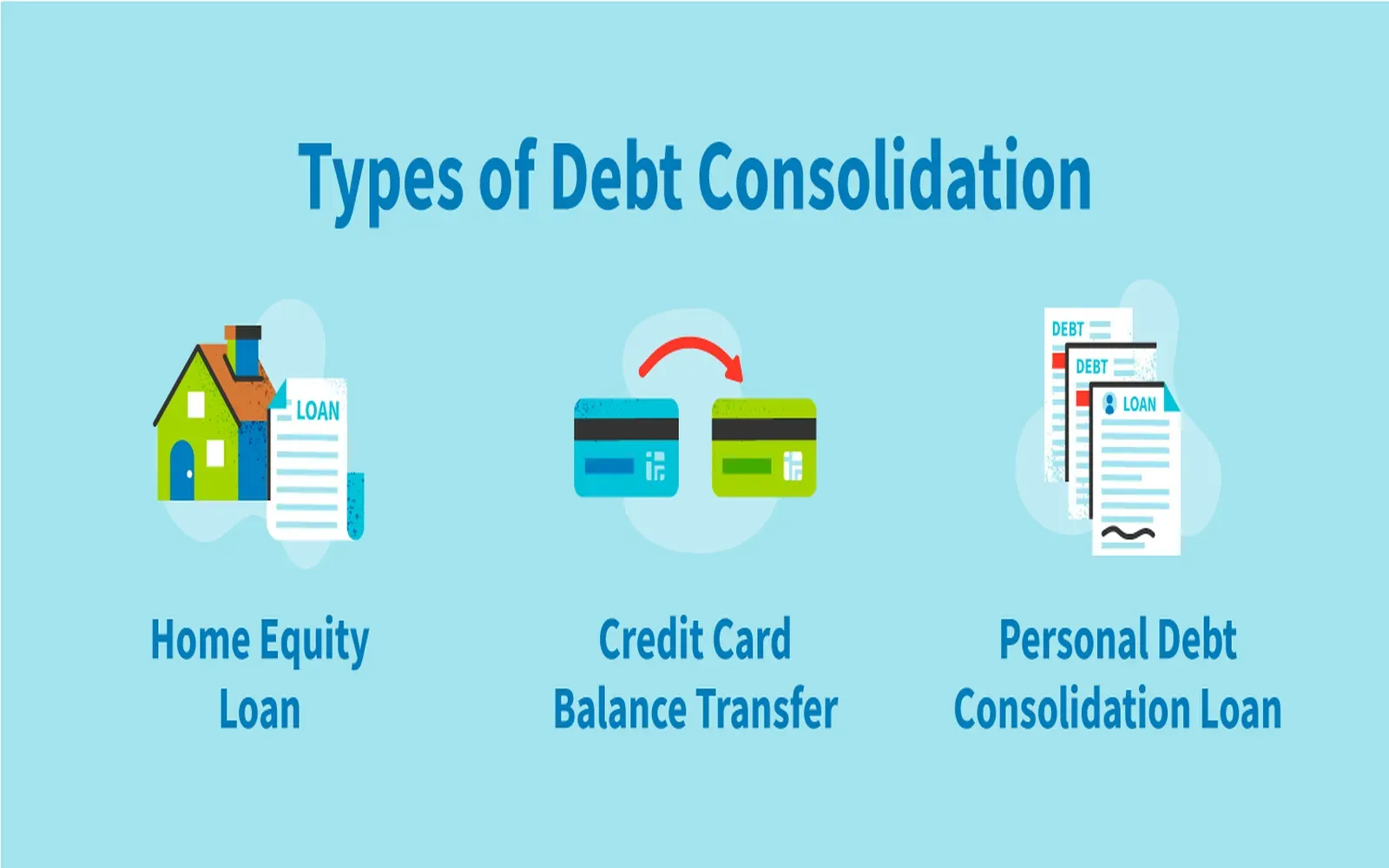

Debt consolidation involves combining multiple debts into a single loan or payment plan. This simplifies payments, often lowers interest rates, and can reduce monthly bills. It’s an effective strategy for those struggling to keep track of credit cards, personal loans, and other debts.

Benefits of Using Debt Consolidation Services

- Single monthly payment: Easier budgeting with one payment instead of many.

- Lower interest rates: Potentially reduce the cost of debt repayment.

- Improve credit score: On-time payments on consolidated debt can boost credit health.

- Reduced stress: Simplified finances provide peace of mind.

How to Choose the Best Debt Consolidation Service

When selecting a debt consolidation service, consider:

- Interest rates and fees: Look for competitive APRs and low or no fees.

- Loan terms: Flexible repayment periods tailored to your budget.

- Customer service: Responsive and trustworthy support.

- Reputation: Reviews and ratings from real users.

- Eligibility: Minimum credit score requirements and income verification.

Top Debt Consolidation Services Compared 2025

1. SoFi Personal Loans

- APR: 6.99% – 22.99%

- Loan Amounts: $5,000 – $100,000

- Loan Terms: 2 – 7 years

- Key Features: No origination fees, unemployment protection, excellent customer service

- Best For: Borrowers with good to excellent credit looking for large loan amounts

2. Marcus by Goldman Sachs

- APR: 6.99% – 19.99%

- Loan Amounts: $3,500 – $40,000

- Loan Terms: 3 – 6 years

- Key Features: No fees, flexible payment options, personalized payment date

- Best For: Borrowers seeking no-fee personal loans with predictable payments

3. Avant

- APR: 9.95% – 35.99%

- Loan Amounts: $2,000 – $35,000

- Loan Terms: 2 – 5 years

- Key Features: Accepts lower credit scores, quick funding

- Best For: Borrowers with fair credit needing fast access to funds

4. Discover Personal Loans

- APR: 6.99% – 24.99%

- Loan Amounts: $2,500 – $35,000

- Loan Terms: 3 – 7 years

- Key Features: No origination fees, flexible repayment terms, strong customer satisfaction

- Best For: Those with good credit wanting flexible loan options

5. LendingClub

- APR: 8.05% – 35.89%

- Loan Amounts: $1,000 – $40,000

- Loan Terms: 3 – 5 years

- Key Features: Peer-to-peer lending, fixed rates, no prepayment penalties

- Best For: Borrowers comfortable with peer-to-peer lending platforms

Debt Consolidation Services Comparison Chart

| Service | APR Range | Loan Amount Range | Loan Terms | Fees | Credit Score Requirement | Best For |

|---|---|---|---|---|---|---|

| SoFi | 6.99% – 22.99% | $5,000 – $100,000 | 2 – 7 years | No origination fees | 680+ | Excellent credit, high loan needs |

| Marcus | 6.99% – 19.99% | $3,500 – $40,000 | 3 – 6 years | No fees | 660+ | No fees, flexible payment |

| Avant | 9.95% – 35.99% | $2,000 – $35,000 | 2 – 5 years | Origination fees apply | 580+ | Fair credit, quick funding |

| Discover | 6.99% – 24.99% | $2,500 – $35,000 | 3 – 7 years | No origination fees | 660+ | Good credit, flexible terms |

| LendingClub | 8.05% – 35.89% | $1,000 – $40,000 | 3 – 5 years | Origination fees apply | 600+ | Peer-to-peer lending |

Tips for Successful Debt Consolidation

- Assess your total debt: Know exactly how much you owe and to whom.

- Compare multiple offers: Don’t settle for the first quote; shop around.

- Understand the terms: Read the fine print for fees, penalties, and interest rates.

- Create a budget: Ensure you can afford monthly payments.

- Avoid new debt: Focus on paying off consolidated debt before taking on more.

Conclusion: Find the Right Debt Consolidation Service for Your Financial Goals

In 2025, debt consolidation services offer powerful tools to manage and reduce debt effectively. Whether you have excellent credit or are rebuilding your score, options like SoFi, Marcus, Avant, Discover, and LendingClub provide a range of solutions tailored to different needs.

By comparing rates, terms, fees, and eligibility, you can select the best service to simplify your debt repayment journey, reduce interest costs, and work towards financial freedom.