This is where debt consolidation loans come into play. By consolidating your various debts into one manageable loan, you can simplify your repayments, potentially lower your interest rates, and improve your cash flow. In this article, we'll explore the best debt consolidation loans for small businesses in 2024.

Understanding Debt Consolidation for Small Businesses

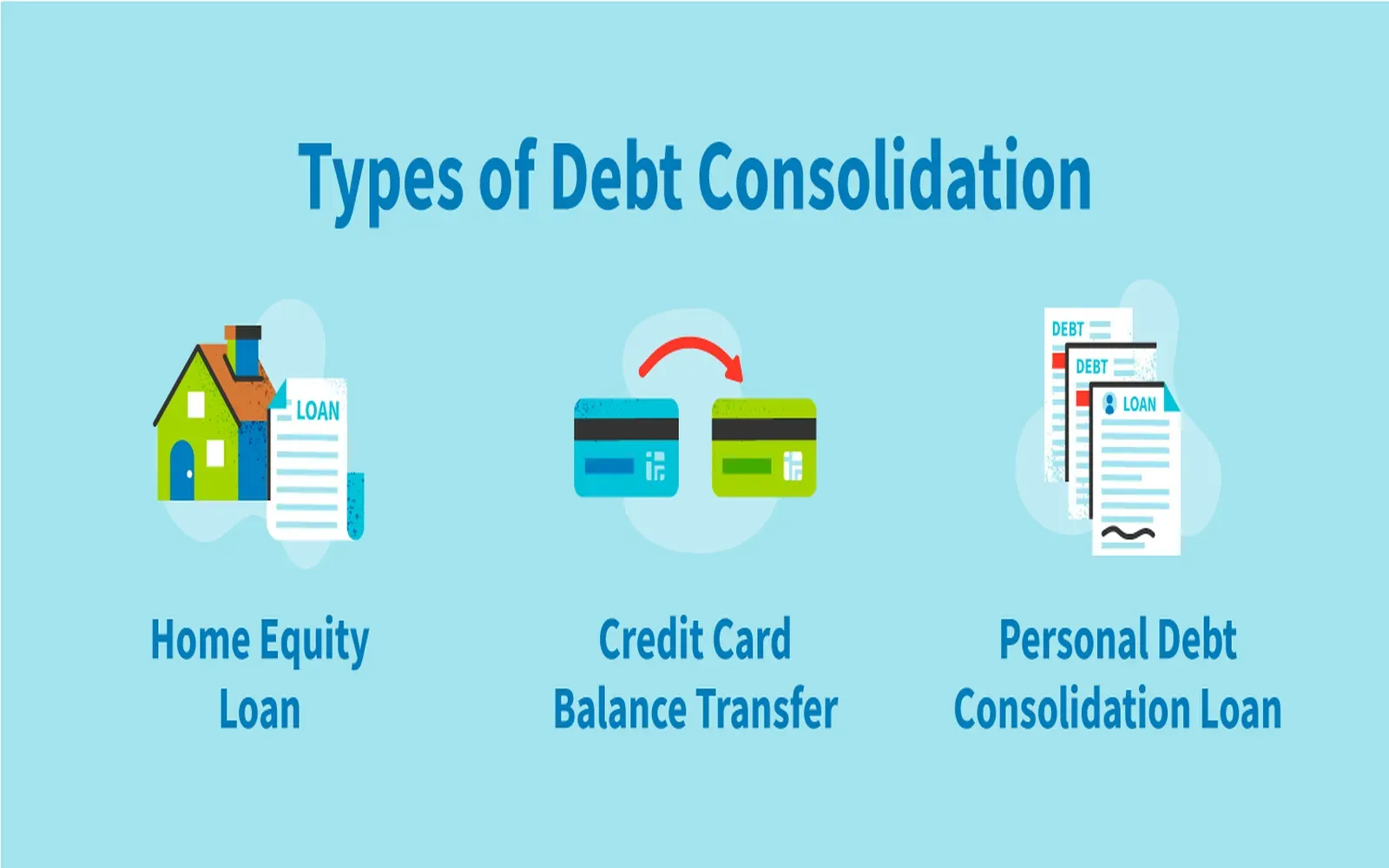

Debt consolidation involves taking out a new loan to pay off multiple existing debts. This approach can be particularly beneficial for small businesses that are struggling with high-interest rates or complex repayment schedules. Consolidation can streamline finances and, in some cases, reduce the overall cost of borrowing.

Top 5 Debt Consolidation Loans for Small Businesses in 2024

Here are some of the best small business debt consolidation loans available in 2024:

1. Fundbox

Fundbox offers flexible financing options tailored to small businesses. Their business line of credit can be used to consolidate multiple debts into one. Fundbox provides quick access to funds, with a straightforward application process and transparent fees.

Key Features:

- Easy online application

- Fast funding within 24 hours

- No prepayment penalties

2. OnDeck

OnDeck is known for its convenient term loans and lines of credit. It's a great option for businesses looking to consolidate debt with fixed monthly payments and competitive interest rates.

Key Features:

- Loan amounts up to $500,000

- Terms ranging from 3 to 36 months

- Personalized service and support

3. BlueVine

BlueVine offers flexible funding solutions, including lines of credit and invoice factoring. Their services can be used for debt consolidation, providing small businesses with the capital they need to manage their debt more effectively.

Key Features:

- Credit lines up to $250,000

- Approval within minutes

- No hidden fees

4. LendingClub

LendingClub provides both personal and business loans that can be used for debt consolidation. Their platform connects borrowers with investors, offering competitive rates and flexible terms.

Key Features:

- Loans up to $500,000

- Fixed rates and predictable payments

- No prepayment penalties

5. Kabbage

Kabbage offers a unique, automated lending platform that makes it easy for small businesses to access lines of credit. These lines of credit can be used for debt consolidation, helping businesses to manage their finances more efficiently.

Key Features:

- Credit lines up to $250,000

- Simple online application

- Funds available within minutes

Best Companies For Consolidating Credit Card Debt

When it comes to consolidating credit card debt, small business owners have several options. The following companies are known for their low debt consolidation solutions:

1. SoFi

SoFi offers personal loans with competitive rates, which can be used to consolidate high-interest credit card debt. They provide flexible repayment terms and excellent customer service.

2. Marcus by Goldman Sachs

Marcus by Goldman Sachs is a reputable lender offering fixed-rate personal loans. Their loans can help small business owners consolidate credit card debt with no fees.

3. Discover Personal Loans

Discover provides personal loans that can be used for debt consolidation. They offer a straightforward application process, fixed rates, and flexible repayment options.

Best Business Consolidation Loans for Bad Credit

Even if you have bad credit, there are still options for consolidating your business debt. Here are some of the best loan options to consolidate debt for small business owners with less-than-perfect credit:

1. Rapid Finance

Rapid Finance offers small business consolidation loans with flexible terms, even for those with bad credit. They provide a range of funding solutions tailored to meet the needs of small businesses.

2. National Funding

National Funding specializes in working with small businesses and offers debt consolidation loans for those with bad credit. Their approval process is quick, and they provide personalized service.

3. Credibly

Credibly offers a variety of financing options, including debt consolidation loans for businesses with bad credit. They focus on providing fast, flexible funding solutions.

Low Interest Debt Consolidation Loan Bad Credit

Finding a low interest debt consolidation loan when you have bad credit can be challenging, but it's not impossible. Here are a few tips to improve your chances:

Improve Your Credit Score

Before applying for a consolidation loan, take steps to improve your credit score. Pay down existing debts, make timely payments, and correct any errors on your credit report.

Consider a Co-Signer

Having a co-signer with good credit can improve your chances of securing a low interest debt consolidation loan. The co-signer agrees to take on the responsibility of the loan if you default.

Shop Around

Different lenders have different criteria and interest rates. Compare multiple lenders to find the best deal for your situation.

Business Debt Consolidation Companies

Several companies specialize in helping small businesses consolidate their debt. These business debt consolidation companies offer various programs to suit different needs:

1. TBS Capital Funding

TBS Capital Funding provides debt consolidation programs specifically for small businesses. They offer personalized solutions and work closely with business owners to manage their debt.

2. Credibly

As mentioned earlier, Credibly offers a range of funding options, including debt consolidation loans. They are committed to providing flexible and fast solutions for small businesses.

3. Fundera

Fundera is a loan marketplace that connects small businesses with the best loan options to consolidate debt. They offer a variety of lenders and products to suit different needs.

Debt Consolidation Programs

Debt consolidation programs can provide structured solutions for managing your business debt. These programs often include financial counseling, debt management plans, and negotiation with creditors.

1. American Consumer Credit Counseling (ACCC)

ACCC offers debt management programs that can help small business owners consolidate and pay off their debts. They provide personalized counseling and support throughout the process.

2. GreenPath Financial Wellness

GreenPath offers comprehensive debt management programs for individuals and small business owners. Their programs include budgeting assistance, creditor negotiations, and financial education.

3. Money Management International (MMI)

MMI provides debt consolidation programs that can help small businesses manage their debt. They offer counseling, debt management plans, and educational resources.

Conclusion

Debt consolidation can be a valuable tool for small business owners looking to streamline their finances and reduce the burden of multiple debts. By choosing the right consolidation loan or program, you can simplify your repayments, potentially lower your interest rates, and improve your overall financial health. In 2024, the options for small business debt consolidation are better than ever, with a variety of lenders and programs available to meet your unique needs. Whether you're looking for the best companies for consolidating credit card debt or the top 5 debt consolidation loans, there's a solution out there for every small business owner.