What Is Bond Laddering?

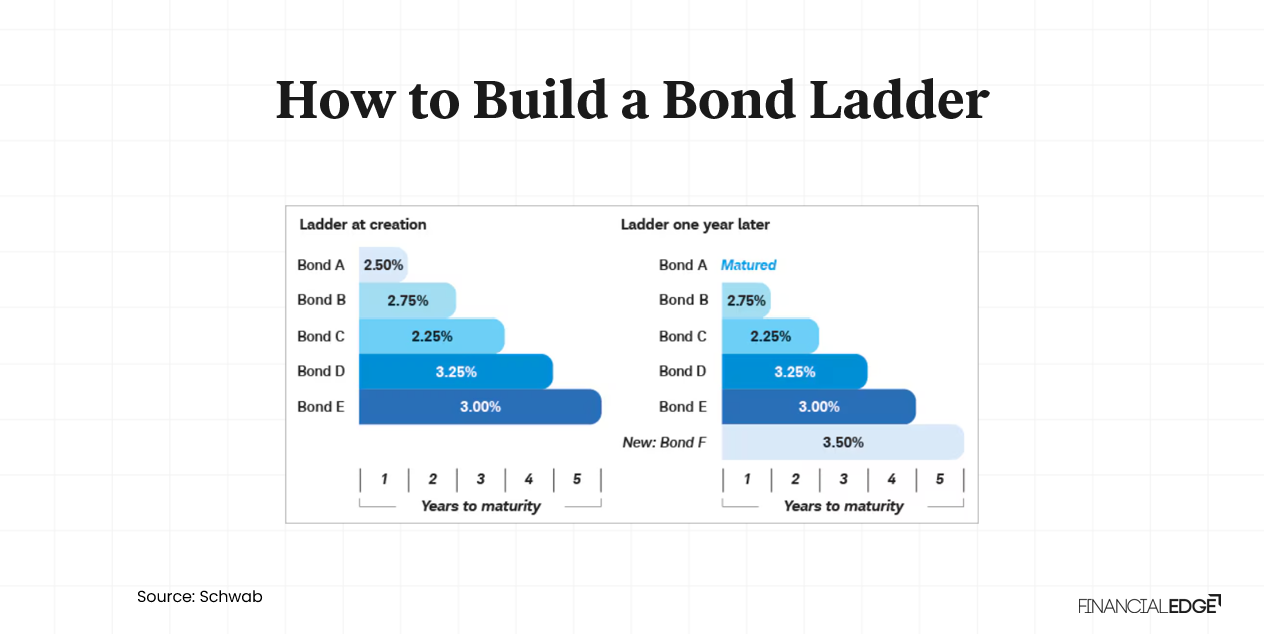

Bond laddering is a strategy that involves purchasing bonds with staggered maturity dates. As each bond matures, the proceeds are reinvested into new bonds at the far end of the ladder. This approach provides regular income, reduces interest rate risk, and ensures liquidity over time.

Why Bond Laddering Matters in 2025

With inflation concerns, fluctuating interest rates, and market volatility, investors are increasingly turning to bond ladders to:

- Lock in interest rates today while preparing for higher yields tomorrow

- Avoid reinvestment risk from bulk bond maturities

- Create predictable income in retirement

- Balance between liquidity and long-term returns

How a Bond Ladder Works

Let’s say you build a 5-year bond ladder with equal investments in bonds maturing each year from 2025 to 2029. As each bond matures, you reinvest the proceeds into a new 5-year bond, keeping the ladder intact and extending the maturity.

Sample 5-Year Bond Ladder (2025–2029):

| Bond Tier | Maturity Year | Investment Amount | Coupon Rate | Income Received |

|---|---|---|---|---|

| Bond 1 | 2025 | $10,000 | 4.0% | $400/year |

| Bond 2 | 2026 | $10,000 | 4.2% | $420/year |

| Bond 3 | 2027 | $10,000 | 4.5% | $450/year |

| Bond 4 | 2028 | $10,000 | 4.7% | $470/year |

| Bond 5 | 2029 | $10,000 | 5.0% | $500/year |

Total Annual Income: $2,240

This setup allows you to benefit from diversification across time horizons, lowering overall risk.

Key Benefits of Bond Laddering

1. Reduced Interest Rate Risk

By spreading investments across different maturities, bond laddering helps protect you from sudden interest rate changes. As older bonds mature, you can reinvest at current market rates, smoothing out volatility.

2. Steady Cash Flow

Each rung of the ladder provides predictable income at regular intervals. This is especially beneficial for retirees or income-focused investors who need liquidity over time.

3. Principal Protection

Since you're holding bonds to maturity, you're not as exposed to market fluctuations. This makes laddering safer than trading bonds on the open market.

4. Reinvestment Flexibility

As bonds mature, you have the option to reinvest based on current economic conditions, giving you financial agility in changing markets.

Best Bonds for Laddering in 2025

When building a bond ladder in 2025, it's essential to consider the types of bonds that align with your risk tolerance, goals, and tax strategy.

| Bond Type | Benefits | Considerations |

|---|---|---|

| U.S. Treasuries | Safe, liquid, no state/local tax | Lower yields than corporate bonds |

| Municipal Bonds | Tax-free income (federal & often state) | Must assess credit quality of issuer |

| Corporate Bonds | Higher yields | Greater credit risk, consider bond ratings |

| CDs (Certificates of Deposit) | FDIC-insured, low risk | Penalties for early withdrawal |

Building an Effective Bond Ladder

Step 1: Define Your Investment Horizon

Decide how long you want the ladder to last. For example, a 5-year ladder offers more frequent maturity and reinvestment opportunities, while a 10-year ladder locks in rates for longer.

Step 2: Choose Your Bond Types

Select bonds that suit your financial goals. If you’re in a high tax bracket, municipal bonds might make more sense. If you're risk-averse, stick to Treasuries or CDs.

Step 3: Diversify Across Issuers and Ratings

Avoid putting all your money into one issuer or bond rating. Diversifying by credit rating and geography adds safety and resilience to your ladder.

Step 4: Reinvest Systematically

As bonds mature, reinvest in new bonds with the longest maturity in your ladder to maintain its structure. For example, when your 2025 bond matures, buy a bond that matures in 2030.

Bond Laddering vs. Other Strategies

| Strategy | Risk Level | Income Stability | Liquidity | Interest Rate Protection |

|---|---|---|---|---|

| Bond Laddering | Low | High | Moderate | Strong |

| Bond Fund | Moderate | Variable | High | Weak |

| CD Ladder | Very Low | High | Low | Moderate |

Bond laddering stands out for balancing return and risk while offering more predictability than bond funds and greater flexibility than fixed CDs.

Is Bond Laddering Right for You?

Consider bond laddering strategies in 2025 if you:

- Want steady, predictable income

- Prefer low-risk investments

- Expect interest rates to fluctuate

- Need access to part of your capital at regular intervals

For many investors—especially retirees and those nearing retirement—laddering bonds offers an attractive combination of security, liquidity, and return.

Final Thoughts

As the financial landscape shifts in 2025, bond laddering remains a proven and strategic method to navigate rising or falling interest rates. By spreading your investments across staggered maturities, you gain control over income, reduce reinvestment risk, and increase your ability to adapt to changing market conditions.

Before starting, consult with a financial advisor to tailor your ladder based on your income needs, tax considerations, and investment timeline. A well-built bond ladder isn’t just a tool—it’s a smart financial foundation.