Construction loans are unique, offering different terms and requirements compared to traditional mortgages. This comprehensive guide will explore the best options for construction loans, including Commercial Building Loans, Contractor Financing, VA Construction Loan Lenders, and more. Let’s dive into what makes a construction loan the best for your needs and which banks stand out in providing these services.

Understanding Construction Loans

What Are Construction Loans?

Construction loans are short-term, high-interest loans designed to cover the costs of building a home or commercial property. Unlike a traditional mortgage, which provides a lump sum, construction loans are disbursed in stages as the project progresses. These loans require detailed plans, a budget, and a timeline, making the approval process more stringent.

Types of Construction Loans

- Residential Construction Loans: These are used for building single-family homes or other residential properties.

- Commercial Building Loans: These loans finance the construction of commercial properties like office buildings, retail spaces, or industrial facilities.

- Contractor Loans and Contractor Financing: These options are tailored for contractors needing funds to manage their projects.

- VA Construction Loan Lenders: These lenders offer construction loans to eligible veterans.

- Private Construction Loans: These are offered by private lenders and often have more flexible terms.

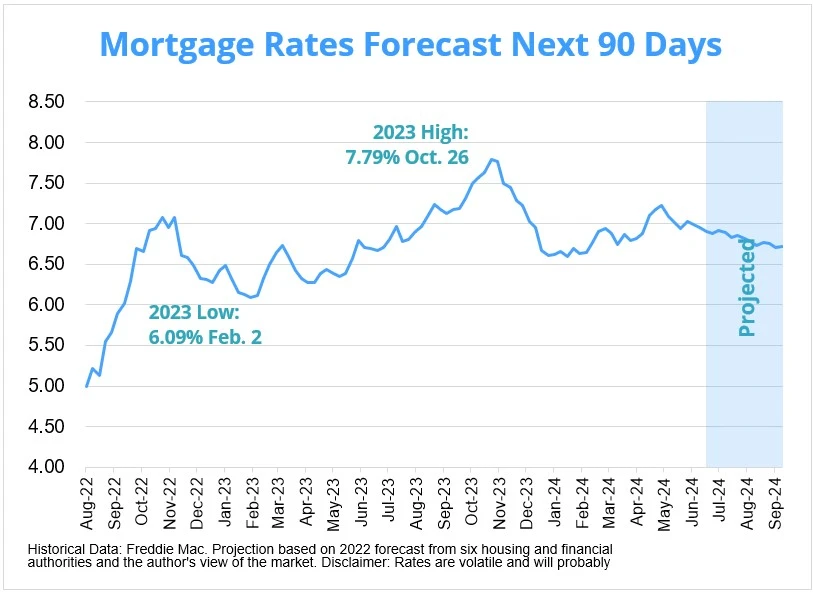

Mortgage Rate Forecast Next 90 Days

Best Construction Loan Companies

When it comes to finding the best construction loan companies, several banks and lenders stand out for their competitive rates, flexible terms, and customer service.

Wells Fargo

Wells Fargo is known for its comprehensive range of loan options, including residential and commercial construction loans. They offer:

- Competitive interest rates

- Flexible loan terms

- A streamlined application process

- Excellent customer service

Wells Fargo’s construction loans are particularly advantageous for those looking to build in California, as they offer specific programs for this state.

Bank of America

Bank of America offers robust construction loan options with benefits like:

- Low down payment requirements

- Interest-only payments during construction

- Conversion to a permanent mortgage once the building is complete

- Online management tools

Their customer-centric approach and extensive branch network make them a convenient choice for borrowers across the country.

US Bank

US Bank is another top contender in the construction loan market. They provide:

- Fixed or adjustable interest rates

- Interest-only payments during the construction phase

- One-time closing costs

- Detailed guidance throughout the loan process

US Bank’s construction loans cater to both residential and commercial projects, making them versatile for various construction needs.

Chase Bank

Chase Bank offers competitive construction loans with features such as:

- One-time close construction-to-permanent loans

- Detailed support from construction loan specialists

- Flexible terms and competitive rates

- Easy online application process

Chase is a reliable option for those seeking a seamless transition from construction to permanent financing.

Navy Federal Credit Union

For veterans and military families, Navy Federal Credit Union is a top choice. They provide:

- VA construction loans with favorable terms

- Competitive interest rates

- No PMI requirements for VA loans

- Support throughout the building process

Navy Federal’s focus on military members ensures they offer tailored solutions that cater to the unique needs of service members.

Best Home Improvement Loan Options‘ Comparison

| Lender | Loan Type | APR Range | Loan Amount Range | Loan Term Length | Key Features |

|---|---|---|---|---|---|

| LightStream | Unsecured Personal Loan | 3.99% - 19.99% | $5,000 - $100,000 | 2 - 12 years | No fees, rate beat program, fast approval and funding |

| SoFi | Unsecured Personal Loan | 5.99% - 18.85% | $5,000 - $100,000 | 2 - 7 years | No fees, unemployment protection, flexible payment options |

| Discover | Unsecured Personal Loan | 5.99% - 24.99% | $2,500 - $35,000 | 3 - 7 years | No origination fees, fixed rates, 30-day return guarantee |

| Wells Fargo | Unsecured Personal Loan | 5.24% - 24.49% | $3,000 - $100,000 | 1 - 7 years | Relationship discounts, quick funding, no origination or prepayment fees |

| Marcus by Goldman Sachs | Unsecured Personal Loan | 6.99% - 24.99% | $3,500 - $40,000 | 3 - 6 years | No fees, on-time payment rewards, tailored payment options |

| Avant | Unsecured Personal Loan | 9.95% - 35.99% | $2,000 - $35,000 | 2 - 5 years | Quick approval and funding, flexible credit requirements, online and mobile account management |

Getting a Construction Loan: What You Need to Know

Requirements for Construction Loans

Securing a construction loan involves meeting several criteria, including:

- Credit Score: A good credit score is essential, typically above 700.

- Down Payment: Construction loans usually require a larger down payment, often between 20-25%.

- Detailed Plans: Lenders need comprehensive plans, budgets, and timelines.

- Builder Approval: The builder must be approved by the lender, ensuring they are reputable and experienced.

- Income Verification: Proof of stable income to ensure you can make the loan payments.

Application Process

The application process for a construction loan involves several steps:

- Pre-approval: Get pre-approved to understand how much you can borrow.

- Submit Plans: Provide detailed plans and budgets for the project.

- Appraisal: An appraiser will assess the project’s value.

- Approval: Once approved, funds are disbursed in stages as construction progresses.

- Construction Phase: Payments are made to contractors upon completion of each phase.

- Conversion: The loan converts to a permanent mortgage once construction is complete.

Contractor Construction Loans

Contractors often need financing to manage cash flow, purchase materials, and cover labor costs. Contractor construction loans are designed to meet these needs with features like:

- Flexible Terms: Customized repayment schedules based on project timelines.

- Quick Disbursement: Fast access to funds to keep projects on track.

- Line of Credit: Access to a revolving line of credit for ongoing expenses.

Best Banks for Contractor Loans

PNC Bank and Wells Fargo are notable for their contractor loan offerings. They provide competitive rates, flexible terms, and strong customer support, making them ideal for contractors needing reliable financing.

Residential Construction Loans in California

California’s real estate market is unique, with high property values and specific regulatory requirements. Banks offering residential construction loans in California include:

Bank of the West

Bank of the West offers specialized programs for California residents, including:

- Fixed and adjustable-rate options

- Interest-only payments during construction

- Local expertise and support

Their familiarity with California’s real estate market makes them a strong choice for residential construction loans in the state.

Union Bank

Union Bank provides comprehensive construction loan services, with features such as:

- One-time close loans

- Competitive interest rates

- Personalized support from local experts

Union Bank’s focus on the California market ensures they understand the specific needs and challenges of building in the state.

Private Construction Loans

For those who may not qualify for traditional bank loans, private construction loans are an alternative. These loans are provided by private lenders and often offer:

- Flexible terms: Customized to meet the borrower’s needs.

- Faster approval: Less stringent requirements can lead to quicker approval.

- Higher interest rates: Reflecting the increased risk for lenders.

Top Private Construction Loan Providers

- LendingHome: Known for quick approvals and flexible terms.

- Patch of Land: Offers competitive rates and fast funding.

- Fundbox: Provides lines of credit specifically for construction projects.

Private construction loans are suitable for those with unique financing needs or less-than-perfect credit scores.

VA Construction Loan Lenders

Veterans have access to VA construction loans, which offer several benefits:

- No down payment requirements

- Competitive interest rates

- No private mortgage insurance (PMI)

- Flexible terms

Best VA Construction Loan Lenders

Navy Federal Credit Union and USAA are leading providers of VA construction loans. They offer tailored services for veterans, ensuring they receive the best possible terms and support throughout the construction process.

Best Home Construction Loans

Home construction loans require careful consideration to ensure they meet your financial and project needs. The best home construction loans offer:

- Competitive interest rates

- Flexible terms

- Comprehensive support throughout the construction process

Top Banks for Home Construction Loans

- Wells Fargo: Known for their robust loan options and excellent customer service.

- US Bank: Offers one-time close loans and detailed guidance.

- Chase Bank: Provides competitive rates and seamless transitions from construction to permanent loans.

Conclusion

Choosing the best construction loan depends on your specific needs, whether it’s for a residential home, a commercial building, or a contractor managing multiple projects. Leading banks like Wells Fargo, Bank of America, and US Bank offer comprehensive loan options with competitive rates and flexible terms. For veterans, Navy Federal Credit Union and USAA provide excellent VA construction loans. Private lenders such as LendingHome and Patch of Land offer alternatives for those needing more flexible terms. By understanding your project requirements and exploring these top lenders, you can secure the best construction loan to bring your vision to life.