Whether you're a first-time homebuyer or looking to refinance your existing mortgage, online platforms offer a range of options tailored to your needs. In this article, we'll explore various aspects of online home mortgage solutions, including how to get online home mortgage, VA home loan & financing, refinance home loan options, and more. Let's unlock the door to your dream home!

The Convenience of Online Home Mortgage Solutions

Online home mortgage solutions have revolutionized the way people approach home buying and refinancing. The traditional process of visiting multiple banks and mortgage lenders can be time-consuming and overwhelming. However, with online platforms, you can now compare various mortgage options, get pre-approved, and even complete the entire application process from the comfort of your home.

How to Get Online Home Mortgage

Getting an online home mortgage is a straightforward process. Here are the steps to follow:

Some best home mortgage lenders comparisons in 2024

| Lender | Interest Rates | Loan Options | Customer Service | Unique Features |

|---|---|---|---|---|

| Quicken Loans | Competitive fixed and adjustable rates | Conventional, FHA, VA, Jumbo | Highly rated, 24/7 support | Streamlined online application, Rocket Mortgage technology |

| Wells Fargo | Competitive fixed and adjustable rates | Conventional, FHA, VA, Jumbo | Good customer support, local branches | Rate lock guarantee, diverse loan options |

| Chase | Competitive fixed and adjustable rates | Conventional, FHA, VA, Jumbo | Strong customer service, local branches | $500 closing guarantee, robust mobile app |

| Bank of America | Competitive fixed and adjustable rates | Conventional, FHA, VA, Jumbo | Strong customer service, local branches | Digital mortgage experience, Preferred Rewards members benefits |

| Better.com | Low rates, no lender fees | Conventional, Jumbo | Online-only, 24/7 support | Fast pre-approval process, price match guarantee |

| US Bank | Competitive fixed and adjustable rates | Conventional, FHA, VA, Jumbo | Strong customer service, local branches | Customized loan options, extended rate lock |

| Veterans United Home Loans | Competitive fixed and adjustable rates | VA loans primarily | Excellent for veterans, top-rated support | Specialized in VA loans, extensive VA loan expertise 4o |

- Research and Compare Lenders: Start by researching different online mortgage lenders. Look for reviews, ratings, and feedback from other customers to find reliable options.

- Submit an Online Application: Once you've selected a lender, you can fill out an online application. This usually involves providing personal and financial information.

- Provide Documentation: You may need to upload documents such as proof of income, tax returns, and identification.

- Get Pre-Approved: After submitting your application, the lender will review your information and provide a pre-approval letter if you qualify.

- Choose Your Mortgage: Compare the mortgage offers you receive and choose the one that best suits your needs.

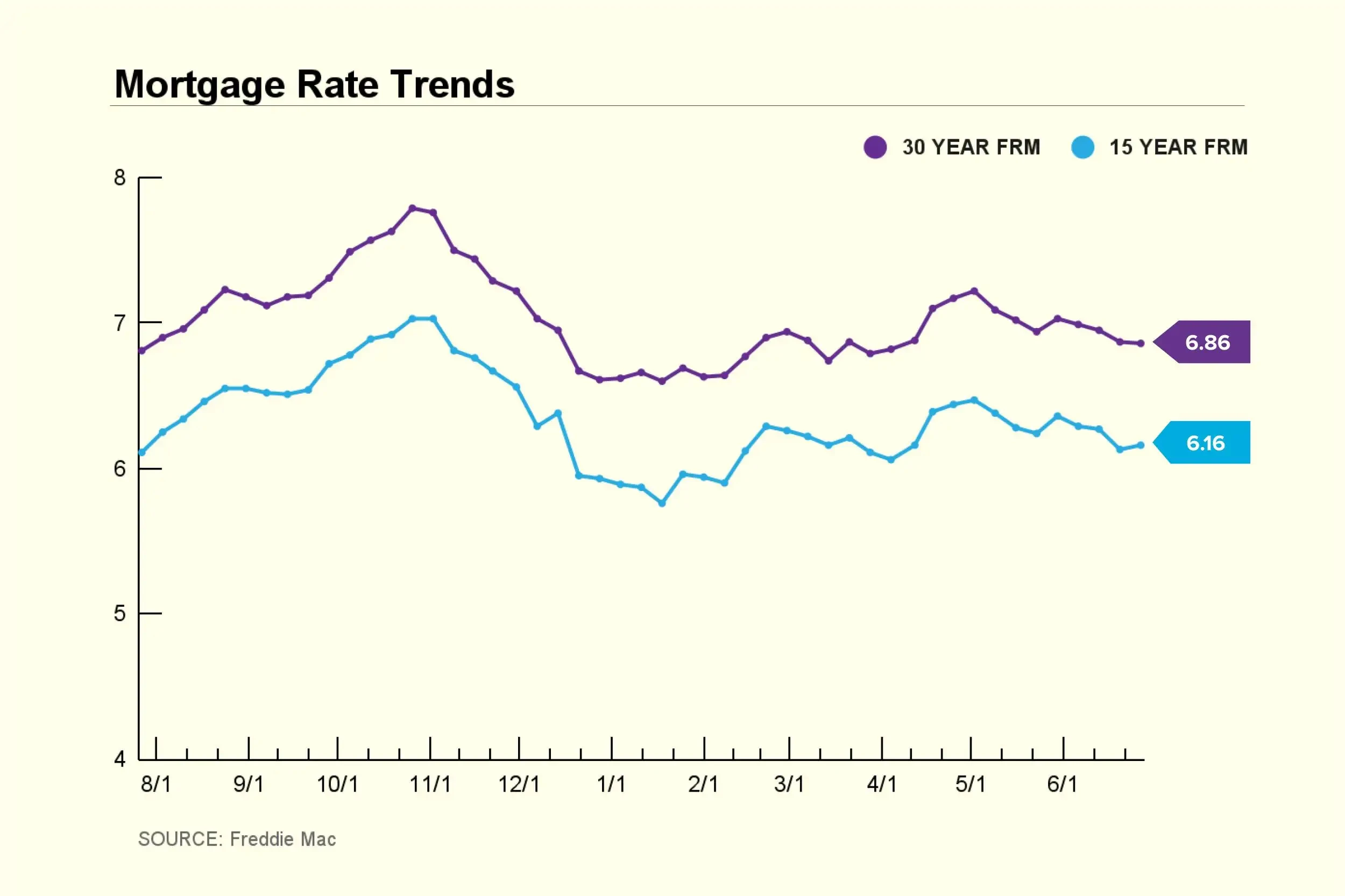

Current Mortgage Rates: Week of July 1 to July 5, 2024