Why Fintech Apps Matter in 2025

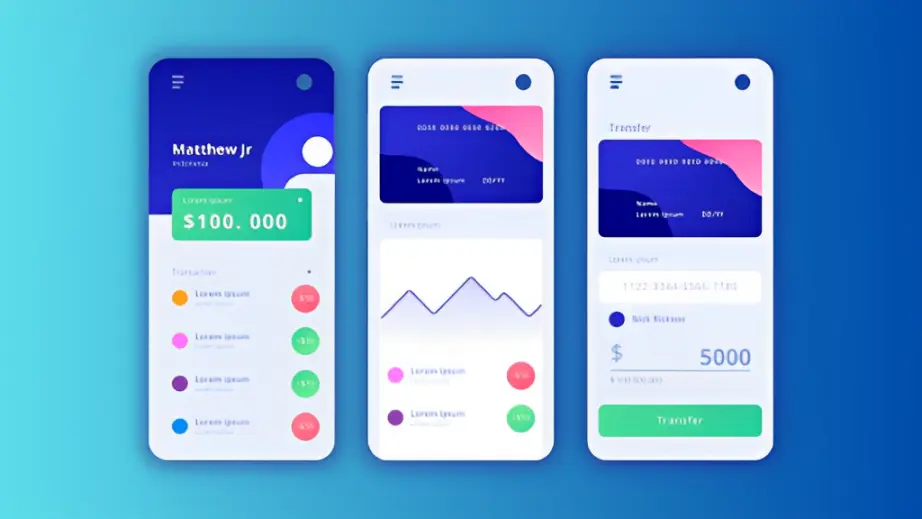

Fintech apps simplify financial processes, offering users instant access to banking, investing, credit, and payments—all from a smartphone. As more consumers go mobile-first, traditional banks are losing ground to agile, user-friendly financial technology platforms.

Key Benefits of Fintech Apps:

- 24/7 accessibility

- Real-time transaction tracking

- Lower fees and better interest rates

- AI-powered financial insights

- Seamless integration with other services

Chart: U.S. Fintech App Usage in 2025

| Category | % of U.S. Adults Using Apps |

|---|---|

| Digital Banking | 78% |

| Budgeting Tools | 62% |

| Investing Platforms | 56% |

| Buy Now, Pay Later | 41% |

| Crypto Wallets | 29% |

Source: Statista & Pew Research, 2025

Top Fintech Apps to Watch in 2025

Below are the top fintech apps in 2025 that are dominating their categories across the U.S.

1. Chime – Best for Mobile Banking

Chime remains a top contender in the digital banking space. With no monthly fees, early direct deposits, and fee-free overdrafts, it's ideal for those wanting a banking alternative without the hassle.

Features:

- No minimum balance

- Round-up savings tool

- Get paid up to 2 days early

Bold keyword: Best mobile banking app 2025

2. Robinhood – Best for Beginner Investing

Robinhood pioneered commission-free stock trading and continues to shine in 2025 by expanding into retirement accounts and crypto trading.

Key Highlights:

- Fractional share investing

- No account minimum

- Real-time crypto trades

Best for: Millennials and Gen Z starting their investment journey

3. SoFi – Best All-in-One Financial App

SoFi combines banking, investing, student loan refinancing, credit cards, and financial planning—all in one app.

Why It’s a Top Fintech App:

- High-yield savings account

- Commission-free ETF trades

- Free financial advisor access

Bold keyword: Top all-in-one fintech platform

4. Acorns – Best for Passive Saving and Investing

Acorns rounds up your everyday purchases and invests the spare change. In 2025, it’s even more popular among Americans who want to build wealth automatically.

Key Benefits:

- Automated micro-investing

- Retirement and custodial accounts

- Financial literacy content

Great for those who want a hands-off approach to investing.

5. Truebill (Rocket Money) – Best Budgeting & Subscription Tracker

With subscription costs rising, Truebill (now Rocket Money) helps users track expenses, cancel subscriptions, and negotiate bills.

Key Tools:

- AI-powered budgeting

- Smart savings goals

- Subscription alerts

Ideal for: Anyone looking to improve their personal financial management

6. Affirm – Best Buy Now, Pay Later App

The BNPL trend continues to surge, and Affirm leads the pack in 2025. It allows users to split payments over time with no hidden fees.

Features:

- Transparent pricing

- Integrates with major U.S. retailers

- Soft credit checks only

Bold keyword: Best BNPL app in the U.S.

Chart: Top Fintech Apps by User Rating (2025)

| App | App Store Rating | Google Play Rating | Monthly Active Users (Est.) |

|---|---|---|---|

| Chime | 4.8 | 4.6 | 15M |

| Robinhood | 4.7 | 4.5 | 13M |

| SoFi | 4.6 | 4.4 | 9M |

| Acorns | 4.7 | 4.3 | 7M |

| Rocket Money | 4.5 | 4.2 | 6M |

| Affirm | 4.6 | 4.5 | 10M |

How to Choose the Right Fintech App

1. Identify Your Financial Goals

Are you trying to budget, save, invest, or borrow? Each app excels in specific areas.

2. Check Fees and Terms

While many fintech apps advertise "free," some services carry fees. Read the fine print.

3. Review Security and Data Privacy

Ensure the app uses bank-level encryption, two-factor authentication, and is FDIC-insured, if applicable.

4. Look for Integration

Choose apps that integrate with your bank accounts, credit cards, or financial planning tools.

Final Thoughts: Embrace the Future of Finance

The top fintech apps in 2025 aren’t just trendy—they’re reshaping how Americans think about money. Whether you need a mobile bank, a micro-investing tool, or an AI-powered budget assistant, there’s a fintech solution that fits.

By choosing the right platforms, you can save more, spend smarter, and grow wealth with less stress. As fintech continues to evolve, staying informed is key to staying ahead.