What Are High Net Worth Management Services?

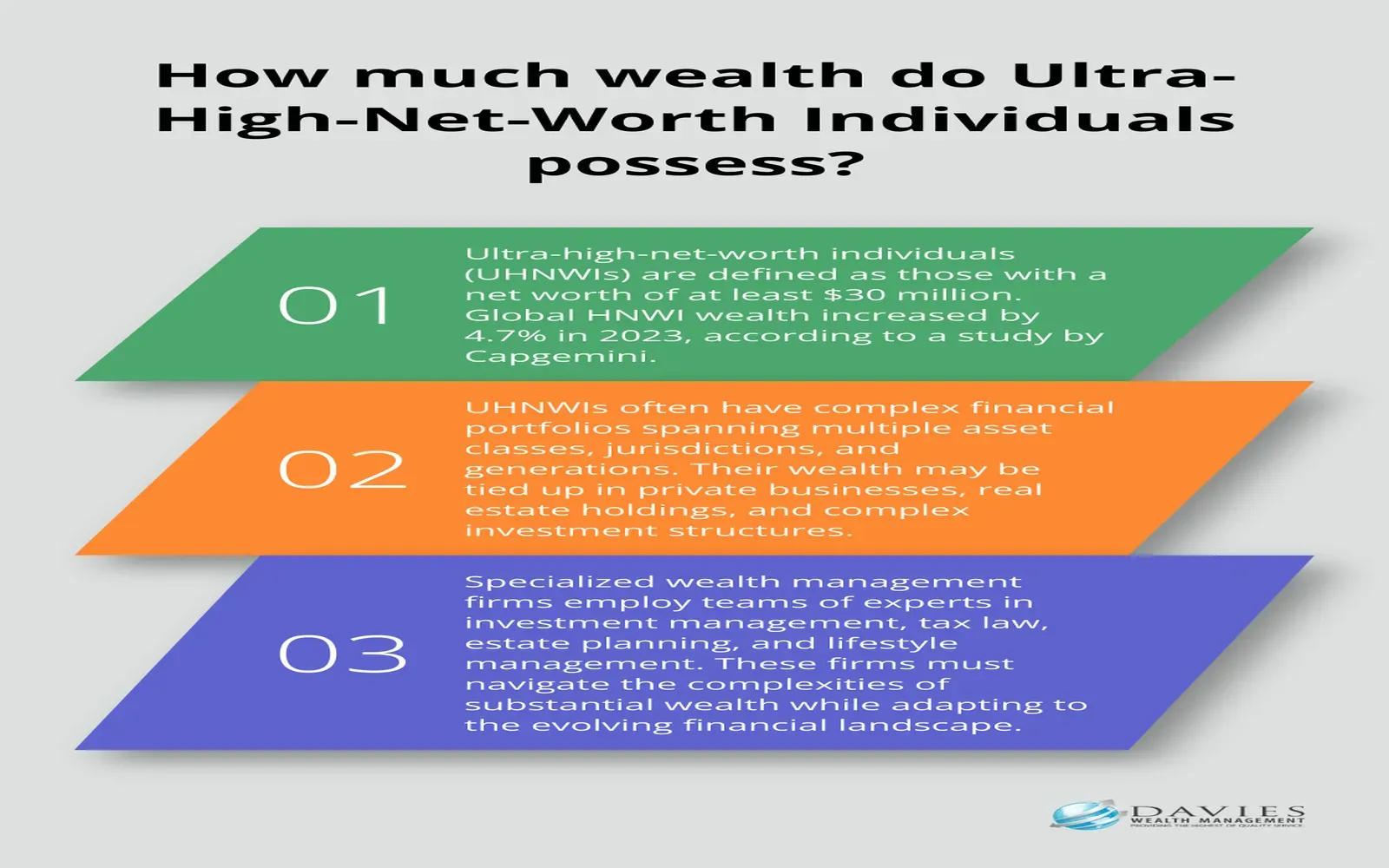

High net worth management services cater to individuals with significant assets, typically $1 million or more in investable wealth. These services provide comprehensive financial management, including investment advisory, estate planning, tax optimization, risk management, and philanthropy support.

Key Components of High Net Worth Management Services

| Service Area | Description | Benefits |

|---|---|---|

| Investment Management | Customized portfolios with diversified assets | Maximize returns, reduce risk |

| Tax Planning | Strategies to minimize tax liabilities | Enhance after-tax wealth |

| Estate Planning | Wills, trusts, and succession planning | Secure legacy and family wealth |

| Risk Management | Insurance and asset protection strategies | Safeguard against unforeseen events |

| Philanthropic Advisory | Guidance on charitable giving and foundations | Maximize social impact and tax benefits |

Top High Net Worth Management Services in 2025

1. Personalized Investment Advisory

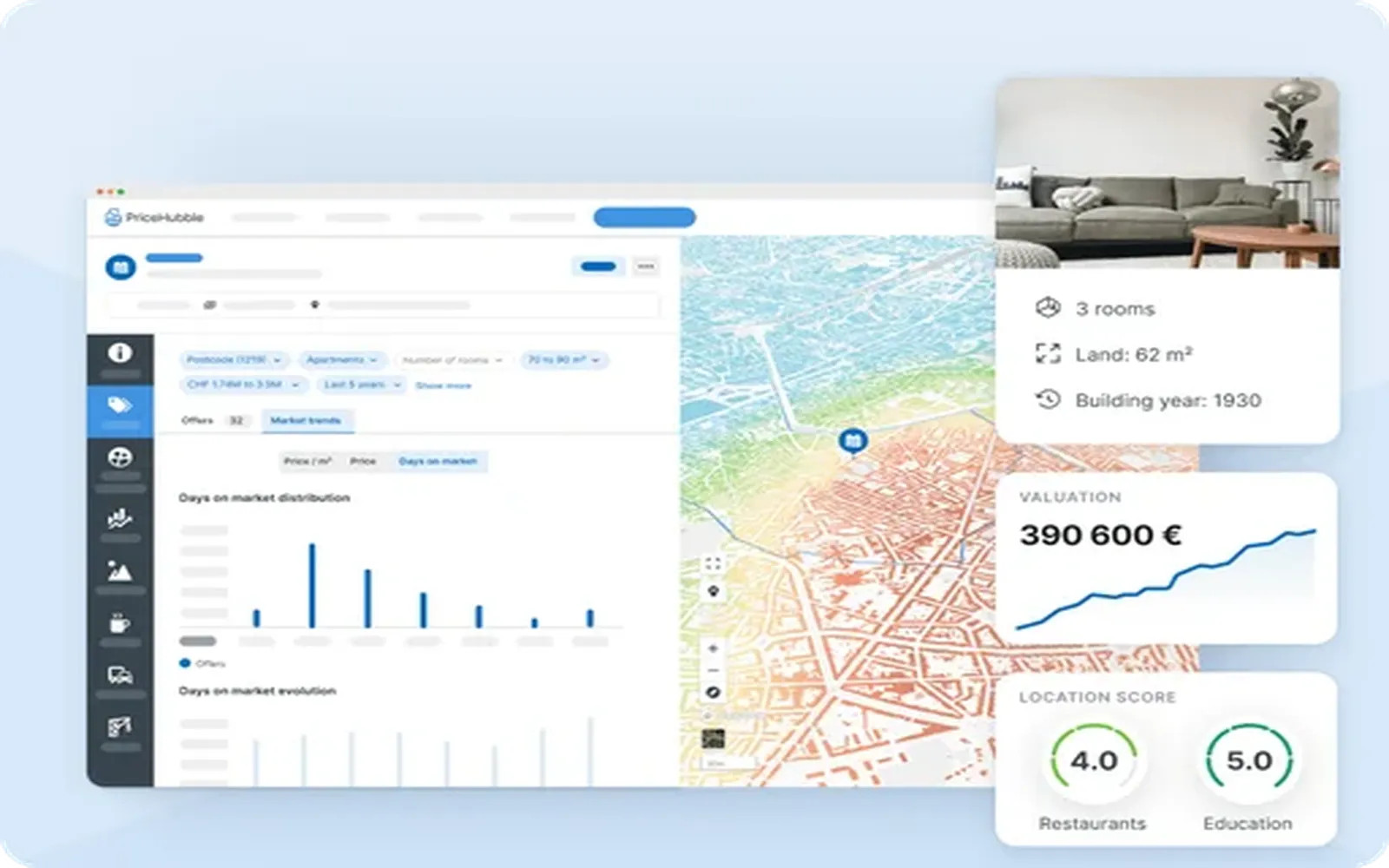

Wealth managers use data-driven insights and AI tools to create personalized investment portfolios tailored to client goals, risk tolerance, and market conditions.

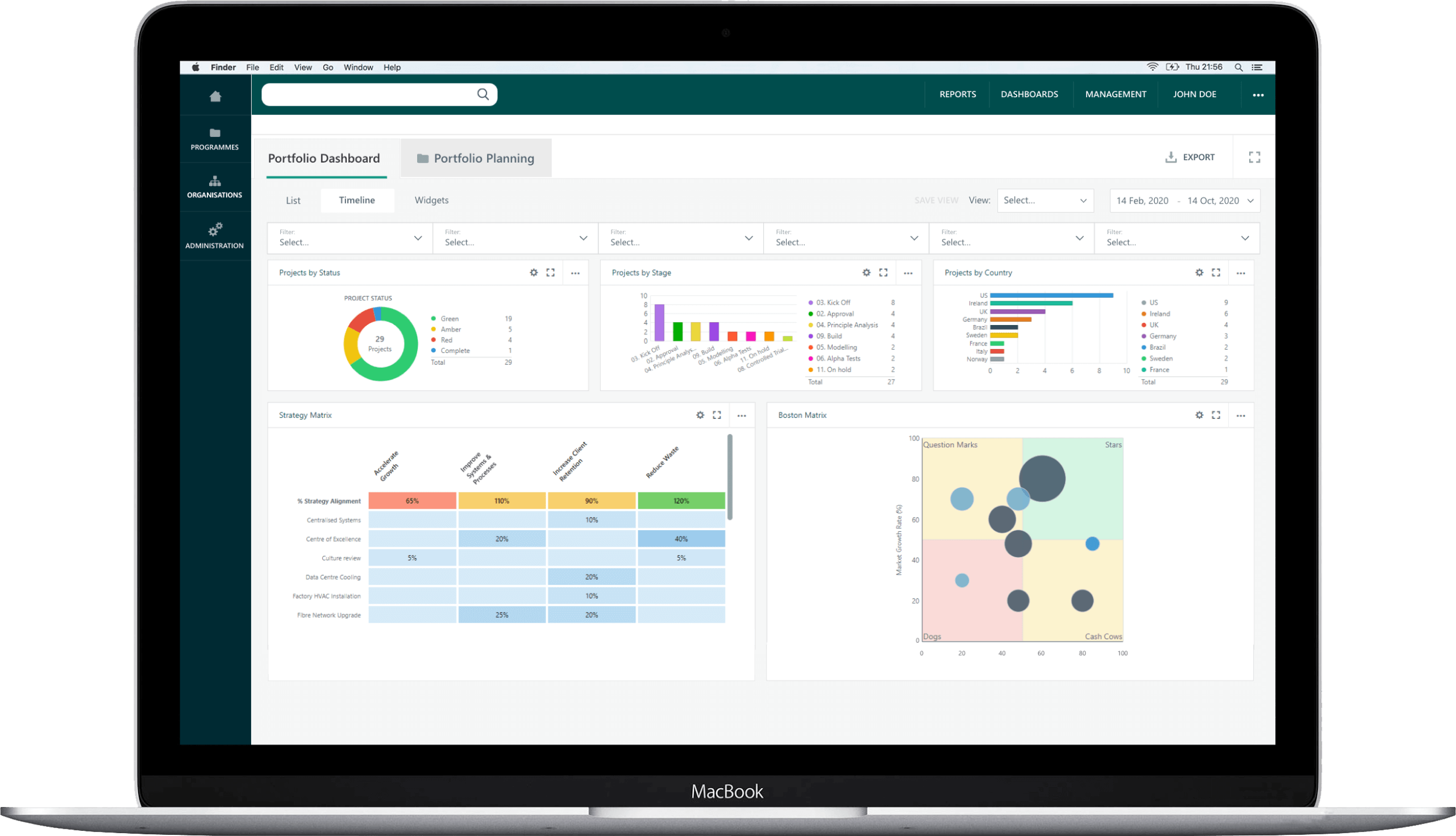

2. Integrated Financial Planning

Beyond investments, advisors provide holistic planning, including retirement, education funding, and cash flow management to align with long-term objectives.

3. Advanced Tax Optimization

Using strategies like tax-loss harvesting, charitable donations, and trusts, high net worth clients can legally minimize their tax burdens.

4. Estate and Legacy Services

Estate planning ensures smooth wealth transfer, minimizes probate costs, and incorporates philanthropic goals through foundations or donor-advised funds.

5. Access to Exclusive Investment Opportunities

Clients often gain entry to private equity, hedge funds, and real estate deals unavailable to general investors, potentially boosting returns.

Chart: Asset Allocation Trends in High Net Worth Portfolios (2020-2025)

| Asset Class | 2020 (%) | 2023 (%) | 2025 (Projected %) |

|---|---|---|---|

| Equities | 50 | 48 | 45 |

| Fixed Income | 25 | 22 | 20 |

| Alternative Assets | 15 | 20 | 25 |

| Cash & Cash Equivalents | 10 | 10 | 10 |

Choosing the Right Wealth Management Partner

- Reputation and Experience: Look for firms with a strong track record serving high net worth clients.

- Customized Approach: Avoid one-size-fits-all solutions; personalized strategies are crucial.

- Transparent Fees: Understand fee structures, including advisory and management fees.

- Technology Integration: Platforms offering seamless digital access and reporting enhance client experience.

- Comprehensive Services: Seek firms that provide end-to-end financial, tax, and estate planning.

Emerging Trends in High Net Worth Management for 2025

| Trend | Description |

|---|---|

| ESG and Impact Investing | Focus on sustainable investments aligning with client values |

| Digital Wealth Platforms | Enhanced AI-driven advisory and portfolio management tools |

| Family Office Services | Tailored support for ultra-high net worth families including lifestyle and succession planning |

| Cybersecurity Focus | Protecting sensitive financial information from digital threats |

Benefits of Using High Net Worth Management Services

- Peace of Mind: Expert management reduces financial stress and complexity.

- Optimized Growth: Professional strategies aim to enhance portfolio performance.

- Legacy Preservation: Structured estate planning safeguards wealth for future generations.

- Tax Efficiency: Strategic planning keeps more wealth in your hands.

- Access and Opportunities: Exclusive deals and insights are typically available only through wealth managers.

Conclusion: Secure Your Financial Future with Expert High Net Worth Management in 2025

In 2025, high net worth management services combine advanced technology, personalized advice, and comprehensive planning to help affluent individuals grow, protect, and transfer their wealth efficiently. Selecting the right management partner is key to unlocking these benefits and ensuring your financial goals are met with confidence. Explore the latest services today to elevate your wealth management strategy.