What Is Margin Trading?

Margin trading involves borrowing money from a broker to buy securities, allowing you to amplify your potential returns. However, it also increases risk. That’s why choosing the right brokerage for margin trading is crucial.

Key Features of a Good Margin Brokerage:

- Low margin interest rates

- High-quality trading platforms

- Transparent margin requirements

- Strong risk management and support tools

- Mobile and desktop trading access

Top Brokerages for Margin Trading in 2025

Here are the top brokerages offering margin trading based on rates, platform quality, and investor support:

Chart: Best Margin Brokerages – 2025 Comparison

| Brokerage | Margin Rate (Over $100K) | Account Minimum | Key Platform Feature |

|---|---|---|---|

| Interactive Brokers | 5.83% | $0 | Advanced risk controls |

| Charles Schwab | 12.75% | $0 | Integrated banking/trading |

| Fidelity | 12.075% | $0 | Comprehensive research tools |

| TD Ameritrade | 13.00% | $0 | Thinkorswim platform |

| Robinhood | 12.00% | $2,000 | Simple mobile-first trading |

| Webull | 9.74% | $2,000 | Community-driven interface |

Rates accurate as of Q2 2025. Subject to change.

#1 Pick: Interactive Brokers – The Leader in Low Margin Rates

Interactive Brokers (IBKR) continues to lead the market in low-cost margin trading. With a margin rate starting at just 5.83% for balances over $100,000, it's ideal for active and professional investors.

Why Choose IBKR?

- Tiered margin rates based on loan size

- Powerful Trader Workstation (TWS) platform

- Global market access in over 150 markets

- Outstanding risk analysis tools

Bold keyword: best brokerage with low margin rates

Best for Beginners: Fidelity Investments

Fidelity combines competitive pricing with exceptional educational resources, making it one of the best brokerages with margin trading for beginners.

Benefits:

- No account minimum

- Access to robust research and reports

- Strong customer service

- Margin rate: ~12.075%

While not the cheapest margin provider, Fidelity offers a safer environment for those still learning the ropes.

Best Mobile Experience: Robinhood

For traders who prefer simplicity and speed, Robinhood offers easy-to-use mobile trading with margin access via Robinhood Gold.

Pros:

- $5/month fee includes $1,000 of margin

- Margin rate: ~12.00%

- User-friendly for mobile-first traders

This platform is perfect for those prioritizing accessibility and low fees, but it lacks some of the advanced tools found on professional platforms.

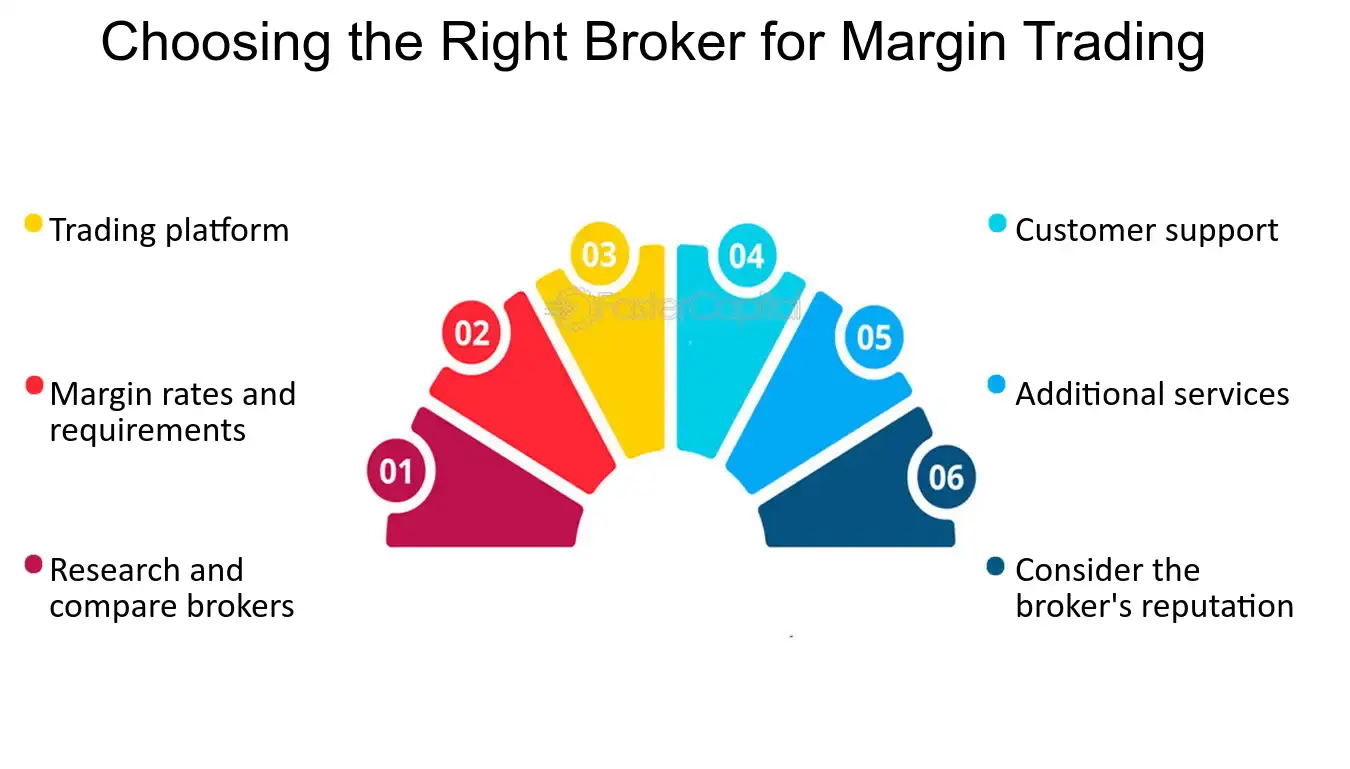

What to Consider Before Choosing a Margin Account

1. Interest Rate Tiers

Some brokers, like Interactive Brokers, have tiered interest rates, meaning larger loans may qualify for lower rates.

2. Platform Quality

Margin trading requires precision. Choose platforms with real-time risk analysis, advanced charting, and order control.

3. Margin Requirements

Each brokerage sets its initial and maintenance margin requirements. Understand them to avoid margin calls.

4. Support and Education

Ensure the broker offers clear guidance and risk tools, especially if you're new to leveraged investing.

Chart: Margin Rate Trends 2020–2025

| Year | Avg. Margin Rate (Top 5 Brokers) |

|---|---|

| 2020 | 8.25% |

| 2021 | 7.85% |

| 2022 | 9.10% |

| 2023 | 10.20% |

| 2024 | 11.50% |

| 2025 | 12.10% |

Rising interest rates have pushed up brokerage margin costs across the board.

Tips for Safe Margin Trading

Margin trading can magnify gains—and losses. Use these best practices to stay in control:

- Start small: Don’t max out your margin right away.

- Use stop-loss orders: Limit downside risk.

- Track buying power: Monitor your leverage closely.

- Stay diversified: Don’t margin one concentrated stock.

- Have cash reserves: Be ready for margin calls.

Final Thoughts: Which Broker Is Right for You?

The best brokerage with margin trading in 2025 depends on your trading style and financial goals. Choose Interactive Brokers for the lowest rates and pro tools, Fidelity for education and support, and Robinhood or Webull for mobile-first simplicity.

As interest rates remain high in 2025, your choice of broker will directly impact your borrowing costs and portfolio risk. Choose wisely, manage your leverage carefully, and always trade with a margin strategy.